Main differences between EMI and PSP

EMI functionality and capabilities

An EMI license opens up the widest range of possibilities for fintech:

- Issuance of electronic money: the right to issue electronic money and ensure its circulation within payment services, e-wallets, mobile applications.

- Opening accounts and e-wallets: clients can have individual IBANs, multi-currency accounts, integration with SEPA and SWIFT for international payments.

- Safeguarding client funds: client funds are protected by segregation, which increases trust in the service.

- Issuing payment cards: the ability to issue proprietary cards (Visa, Mastercard, etc.), which is especially in demand for startups, digital banks, and mobile wallets.

- Access to international payment infrastructures: direct connection to SEPA, SWIFT, issuing IBANs for foreign companies.

PSP functionality

A PSP license is a tool for companies that do not need to hold client funds:

- Execution of payments without holding funds: a PSP acts as a payment operator, providing instant transfers, mass payouts, currency exchange, but does not accumulate client funds.

- Mass payments and currency conversion: a PSP license is in demand for mass payout services (e.g., freelance platforms, marketplaces), as well as for exchange offices and payroll payout services.

- Opening accounts for clients: it is possible to provide IBANs for foreign companies; however, without the right to hold funds for a long period.

- Restrictions on holding funds: a PSP cannot retain client funds longer than the established period (usually 24–48 hours), which imposes limitations on the business model.

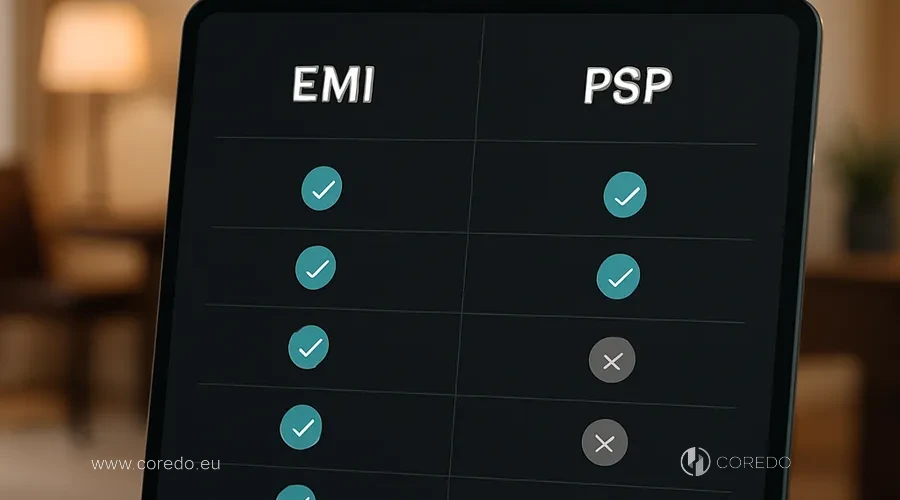

Comparison table: EMI and PSP

| Parameter | EMI license | PSP license |

|---|---|---|

| Holding of funds | Yes | No |

| Issuance of electronic money | Yes | No |

| Issuing payment cards | Yes | No |

| Opening accounts/wallets | Yes | Yes |

| Access to SEPA/SWIFT | Yes | Limited |

| IBAN for foreign companies | Yes | Yes |

| Minimum capital | 350 000 EUR | 125 000 EUR |

| Time to obtain | 6–12 months | 3–6 months |

| AML requirements | High | Medium |

| Transaction restrictions | Yes (sEMI, EMI) | Yes (sPI, PSP) |

EMI or PSP: How to choose a license for fintech

The choice of license for fintech depends on the specifics of your services and the requirements for issuing electronic money.

When an EMI license is needed

An EMI license is required if you:

- are launching e-wallets, a digital or online bank, a mobile wallet that stores funds, issues cards, and integrates with international payment systems.

- plan to scale a payment service: entering international markets, working with foreign customers, providing IBANs.

- are building a fintech platform that issues electronic money — for example, for SaaS, a marketplace, the crypto industry, or B2B/B2C services.

When a PSP license is needed

A PSP license is optimal if:

- your business model involves mass payments, transfers, currency exchange, or payroll — you do not store clients’ funds but only enable their fast processing.

- you need quick Licensing and launch: the timeframe for obtaining a PSP license is shorter, and the requirements for share capital and compliance are lower.

- you work with international clients: a PSP license is suitable for mass payout services, e-commerce, SaaS, freelance platforms, and exchange services.

EMI and PSP for international business, examples

EMI and PSP: regulation and requirements in the EU and worldwide

Minimum statutory capital and financial requirements

- EMI license: minimum statutory capital – 350 000 EUR. For small EMIs (sEMI), from 50 000 EUR, but with turnover and geographic restrictions.

- PSP license: minimum statutory capital: 125 000 EUR. For small PSPs (sPI) – from 20 000 EUR, also with restrictions on transaction volume.

Timeframes for obtaining a license

- EMI license: from 6 to 12 months, depending on the jurisdiction, the complexity of the corporate structure and the completeness of the documentation.

- PSP license: from 3 to 6 months, which allows faster launch of mass payment services and international transfers.

AML and KYC requirements

- EMI license: strict AML (Anti-Money Laundering) and KYC (Know Your Customer) procedures, mandatory implementation of CDD (Customer Due Diligence) and EDD (Enhanced Due Diligence), regular audits and reporting.

- PSP license: AML requirements and KYC are also high, but the volume of internal control and the depth of customer checks are somewhat lower.

EMI and PSP: comparison by jurisdictions

EMI and PSP in Lithuania

Lithuania – one of the EU leaders in the number of issued EMI and PSP licenses. Advantages:

- Fast application review times (6–9 months for EMI, 3–5 months for PSP).

- Transparent requirements for capital and corporate structure.

- Developed infrastructure for fintech.

EMI and PSP licenses in the Czech Republic

The Czech regulator focuses on transparency and predictability of procedures. Features:

- Stable capital requirements.

- Emphasis on AML procedures and disclosure of beneficial ownership.

- Ability to register as either an EMI or a PSP with minimal bureaucratic barriers.

EMI and PSP in Estonia

Estonia actively supports fintech startups:

- Simplified registration procedures.

- Electronic interaction with the regulator.

- Ability to obtain e-Residency for foreign founders.

EMI and PSP in Singapore

Singapore is one of the most technologically advanced and heavily regulated markets in Asia:

- Strict compliance requirements and financial reporting.

- High entry barrier for EMI and PSP licenses.

- Requirement to have a local director and secretary, and a transparent corporate structure.

How do I register a payment company and obtain a license?

The process of registering a payment company and obtaining a license requires a clear sequence of actions and strict compliance with all regulators’ requirements.

Preparation of the business model and corporate structure

- choosing a jurisdiction: analysis of requirements, timelines and licensing costs, regulatory specifics.

- Development of the business model: defining target markets, payment scenarios, integration with SEPA, SWIFT, IBAN.

- Corporate structure and beneficial control: disclosure of ownership structure, preparation of a governance scheme, appointment of key persons.

Collection of documents for application submission

- Financial reporting: preparation of forecasts, confirmation of sources of capital.

- Internal regulatory documents: AML/KYC policies, CDD and EDD procedures, compliance requirements.

- Regulatory submission package: charter, information on beneficiaries, CVs of key personnel.

Application submission process and interaction with the regulator

- Submitting the application: electronic or paper form, depending on the jurisdiction.

- Interaction with the regulator: responding to inquiries, providing additional documents, participating in interviews.

- Payment systems audit: demonstrating compliance with internal and international standards.

Opening an account and launching operations

- Banking support: selecting a bank, preparing the document package, undergoing compliance procedures.

- Opening an EMI/PSP account: obtaining an IBAN, integration with payment gateways.

- Operations launch: testing payment scenarios, onboarding clients, initiating mass and international payments.

Conclusions and recommendations

- How to choose a license: EMI or PSP? Base your decision on the business model, plans for holding funds, scaling and target markets. For e-wallets, digital banks and services that hold funds choose EMI. For mass payments, currency exchange and rapid launches — PSP.

- Practical steps for registration and launch: a clear business model, a transparent structure, thorough document preparation and professional support are the key to successful licensing.

- Tips for minimizing risks and complying with AML: implement modern AML/KYC procedures, regularly update compliance documents, and invest in employee training.

- How to choose a reliable partner for legal support: pay attention to experience, expertise and the presence of completed cases in your jurisdiction. A comprehensive approach reduces regulatory risks and accelerates market entry.

Frequently Asked Questions (FAQ)

To launch a fintech service in the EU and abroad, an EMI or PSP license is required, as well as additional authorizations to work with cryptocurrencies, mass payments, and currency exchange.

You need to prepare a package of documents (articles of association, corporate structure, information about beneficiaries), undergo compliance procedures and confirm the legality of the sources of funds. Professional support helps to navigate the process at every stage.

AML (Anti-Money Laundering) – a set of measures to prevent money laundering, including KYC, CDD, EDD, internal policies and regular reporting. For EMI and PSP, implementing an effective AML system is a mandatory regulatory requirement.

It is recommended to establish a transparent corporate structure, implement internal regulatory documents, regularly audit payment systems and keep compliance procedures up to date.

Assess experience, expertise, a proven track record of completed cases and transparency of communication. A comprehensive approach ensures long-term resilience and minimizes regulatory risks.