96% of new international companies encounter legal and tax barriers already at the initial stage of entering foreign markets: this fact is confirmed not only by OECD statistics but also by my personal experience at COREDO. Many entrepreneurs, when planning to register a company in Saint Lucia, expect ease and transparency, but reality turns out to be much more complicated: from the nuances of international taxation to AML and KYC requirements that change every year.

In this article I will not only analyze the key conditions for registering an International Business Company in St Lucia, but also show how the COREDO team helps clients realize the potential of this region in practice. Here you will find answers to the most pressing questions, from tax incentives and privacy protection to obtaining Saint Lucian citizenship by investment. I recommend reading to the end: you will receive not only a step-by-step guide but also strategic ideas for developing an international business.

Company registration in St. Lucia

company registration in St. Lucia opens up wide opportunities for entrepreneurs thanks to a simple procedure, favorable tax conditions and owner confidentiality. Below is a step-by-step guide that will help you understand the key stages of registration on the website and prepare to launch a business in this attractive jurisdiction.

Website registration – step-by-step guide

COREDO’s practice confirms: registering an IBC (International Business Company) in St. Lucia is a structured process that requires attention to detail at every stage. The sequence of actions includes:

- Choosing a unique company name and its preliminary reservation.

- Preparation of incorporation documents: Memorandum, Articles of Association, information about directors and shareholders, proof of registered address.

- Submitting an application to the St. Lucia Companies Registry with the full set of documents.

- Payment of the registration fee (usually from 100 to 300 USD, depending on the chosen registered agent).

- Receiving the Certificate of Incorporation and the company’s registration number.

Requirements and documents for registration

To register an IBC in St. Lucia you will need:

- At least one shareholder (individual or legal entity; residency does not matter).

- At least one director (may be a non-resident).

- A registered address in St. Lucia.

- Appointment of a registered agent.

- No minimum share capital requirement: in practice a nominal amount is sufficient (often 1 USD).

- The standard package includes passport copies, proof of address, KYC questionnaires and, if necessary, corporate documents for legal entities.

Tax incentives: conditions and requirements

tax incentives become one of the key factors when choosing a jurisdiction for establishing and conducting international business.

Next, let’s look at which specific requirements are imposed on IBCs and under what conditions tax incentives are granted to such companies.

Tax incentives for IBCs: overview of conditions

- Corporate income tax;

- Taxes on dividends, interest and royalties;

- Stamp duties and capital gains taxes.

At the same time, companies are required to file an annual financial statement, which is in line with the transparency principles adopted in Caribbean financial centers.

Saint Lucia’s tax legislation

Saint Lucia actively implements international standards for the exchange of tax information (CRS, FATCA), which provides a balance between financial confidentiality and the requirements of global regulation. Tax incentives apply to foreign companies if they do not carry out activities on the territory of the country and do not receive income from local sources. This approach makes the jurisdiction attractive for holding structures, investment funds and international trading operations.

Offshore companies in St Lucia

Offshore companies in St Lucia are becoming an increasingly attractive tool for international business thanks to special registration conditions and a flexible tax regime. This jurisdiction offers not only significant tax benefits but also a high level of confidentiality for company owners, making it one of the popular destinations among entrepreneurs.

Benefits of offshore companies

Among the key benefits noted by COREDO clients:

- Asset protection: St Lucia legislation provides effective mechanisms for protecting property from claims by third parties and creditors.

- Financial confidentiality: There is no public register of shareholders and directors, which guarantees anonymity and data protection.

- Corporate structure flexibility: The ability to issue shares with different rights, and to appoint nominee directors and shareholders.

- Minimal reporting requirements: No mandatory audit, an annual declaration is sufficient.

- Access to international trading licenses: Offshore companies can obtain licenses to provide financial services in the Caribbean, including forex, payment systems, crypto operations.

The COREDO team has repeatedly supported projects for opening corporate accounts in leading banks of the Caribbean region and Europe for IBCs from St Lucia, which confirms the practical feasibility of these benefits.

Zero tax rate and incentives

It is important to note that the zero tax rate for IBCs does not exempt them from the need to comply with international AML and KYC requirements.

Data privacy protection

St Lucia enforces a strict business confidentiality policy.

The solutions implemented by COREDO allow an additional increase in anonymity by using trust and holding structures.

Risks and opportunities — what’s important to know?

Risks and opportunities of offshore structures are today considered both from the perspective of potential advantages and from the standpoint of current threats and restrictions that are important to take into account. To make a balanced decision, it is necessary to understand exactly how offshore opportunities can be used and what risks need to be analyzed under the new regulatory conditions.

Analysis of risks and opportunities of offshore jurisdictions

Any offshore jurisdiction combines opportunities and risks. Among the main challenges:

- Increased international scrutiny of offshore companies (FATF, OECD).

- Disclosure requirements under CRS and AML.

- Possible restrictions on opening accounts in foreign banks.

How to mitigate risks

COREDO’s practice shows: the key to success is a transparent and lawful structure, compliance with international standards (AML, KYC), as well as competent support at all stages. To minimize risks we recommend:

- Use only trusted banking and payment solutions.

- Implement internal KYC procedures and AML.

- Regularly audit the corporate structure for compliance with current requirements.

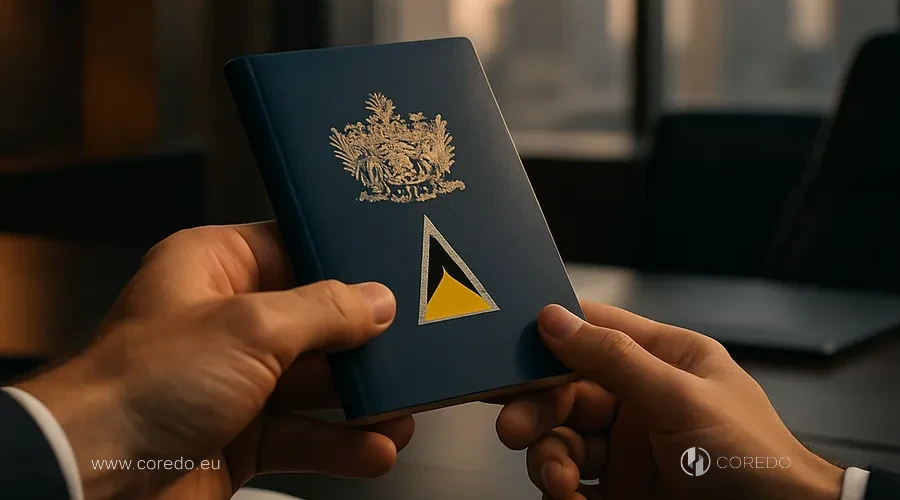

Saint Lucia citizenship by investment

Saint Lucia citizenship for investment, is an opportunity to obtain a second passport by investing a certain amount in the island state’s economy. The program attracts investors with simple conditions and a relatively low investment threshold, making it one of the most accessible in the Caribbean region. Below we will consider what requirements are imposed on candidates and how citizenship can be obtained.

Conditions for obtaining citizenship

The Saint Lucia citizenship by investment program is one of the most attractive in the Caribbean region. The minimum investment amount starts from 240,000 USD (for example, in real estate or government bonds). An alternative route: a non-refundable contribution to the National Economic Fund from 100,000 USD for a single applicant.

Benefits of the Saint Lucia passport:

- Visa-free entry to more than 145 countries, including the Schengen area, the United Kingdom, Hong Kong, Singapore.

- Ability to optimize tax residency.

- No residency requirements on the island.

- Citizenship can be passed on by inheritance.

How to apply

Steps to obtain citizenship:

- Choose an investment option and prepare the document package.

- Undergo a compliance check (Due Diligence).

- Submit the application through a licensed agent.

- Approval and making the investment.

- Receive the passport and certificate of citizenship.

AML and KYC in Saint Lucia

AML and KYC in Saint Lucia are not just international standards, but mandatory requirements for all companies dealing with financial and virtual assets on the island. Saint Lucia’s legislation requires the implementation of strict procedures to combat money laundering (AML) and client identification (KYC) to ensure transparency, financial security and investor protection.

AML and KYC Requirements

Saint Lucia strictly adheres to international AML (Anti–Money Laundering) and KYC (Know Your Customer) standards. Legislation requires:

- Identification of all beneficiaries and shareholders.

- Retention and updating of client information.

- Conducting regular checks of sources of funds.

For companies providing financial services in the Caribbean, the implementation of AML and KYC procedures is a mandatory requirement for obtaining licenses and opening accounts. COREDO’s solutions include the development of tailored AML policies, staff training and process audits.

Practical recommendations for companies

- Implement internal regulations for client identification and monitoring.

- Use modern IT solutions to automate KYC.

- Conduct regular training for employees.

- Timely update documentation in accordance with changes in legislation.

Conclusions and findings

international business company St Lucia: it is not just a tool for tax optimization, but a full platform for developing, protecting and scaling a business on a global scale.

Registering a company in Saint Lucia opens access to tax benefits, financial confidentiality and the opportunities of Caribbean financial centers. Nevertheless, success depends on proper preparation, choosing a reliable partner and complying with all international standards.

Practical recommendations from COREDO:

- Carefully analyze the business’s goals and objectives before registering an IBC.

- Use the advantages of offshore companies to protect assets and optimize tax liabilities.

- Comply with AML and KYC requirements; this is the key to long-term stability.

- Consider Saint Lucia citizenship by investment as a strategic tool for business immigration and expanding opportunities.

The COREDO team is ready to offer comprehensive solutions for registration, licensing and business support in Saint Lucia, taking into account the specifics of your project and current international market trends.

Comparison table of registration requirements and benefits

| Condition | Description |

|---|---|

| IBC registration | Simple and fast registration, no taxes on foreign income |

| Tax benefits | Zero tax rate for IBCs, no taxes on dividends |

| Confidentiality | Protection of founders’ data, no public register |

| Citizenship by investment | Minimum investments from USD 240,000, simplified process |