Benefits of Panama IBC for entrepreneurs from Europe, Asia and the CIS:

- Panama’s territorial tax system: income earned outside of Panama is not taxed, which opens up broad opportunities for tax planning and optimizing a holding structure.

- Flexibility of corporate governance: corporate structure of an IBC allows the use of nominee directors and shareholders, enabling the preservation of confidentiality and simplifying management.

- Confidentiality and asset protection: Panamanian legislation provides a high level of protection for owners’ data, and bearer shares (registered shares) can be used for additional anonymity.

- International reputation and access to global markets: the Panama Canal plays a key role in international trade, and the jurisdiction itself is recognized by global financial institutions and banks.

Requirements for Panama IBC registration in 2025

registration requirements Panama IBC in 2025 include a number of formal and legal procedures that must be followed to lawfully operate and retain all the benefits of the offshore jurisdiction. Before proceeding with company registration in Panama, it is important to understand the key steps, required documents and specifics of the business formation process.

Company registration in Panama: documents and process

Registering a company in Panama requires the preparation of a full package of incorporation documents:

- Articles of Incorporation (company charter), where the objectives, rights and obligations of the participants are set out.

- Minutes of the first meeting of directors and shareholders.

- Confirmation of a unique company name (search in the public register).

- Details of the registered address and the secretariat.

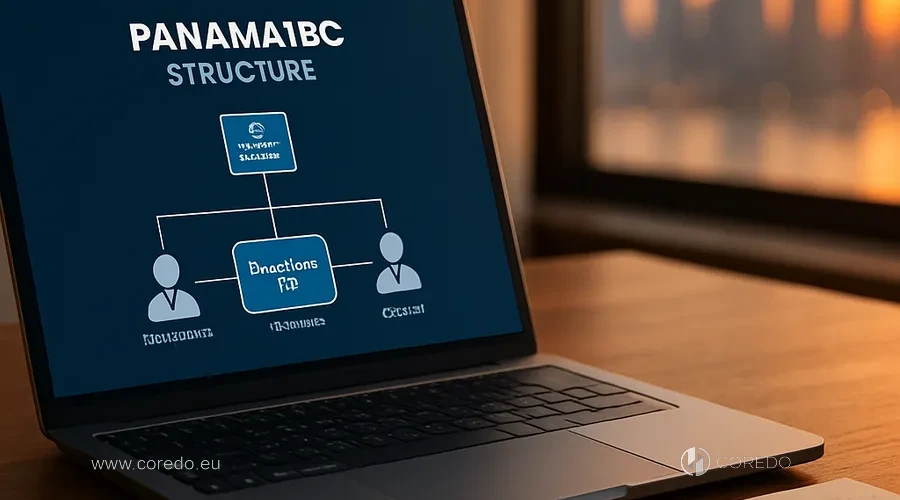

Requirements for directors and shareholders of Panama IBC

Minimum number of directors: one, shareholders: one. The use of nominee directors and shareholders is permitted, which allows beneficiaries to remain anonymous. Nevertheless, since 2020, under the influence of international standards and Law 129, Panama IBC is required to maintain a register of beneficial owners and disclose them upon request by regulators.

Impact of Law 23 (2015) and Law 129 (2020) on company compliance

Law 23 of 2015 tightened AML (Anti-Money Laundering) policy requirements, obliging companies to implement customer identification procedures and transaction monitoring. Law 129 of 2020 introduced a mandatory register of beneficial owners, which increased the transparency of corporate structures.

Panama IBC Tax Regime: Tax Planning

The Panama IBC tax regime opens up broad opportunities for international business and effective tax planning. Thanks to the features of the territorial tax system, income earned outside Panama is fully exempt from local taxes, making the Panama IBC one of the most attractive tools for optimizing corporate structures and reducing tax burden.

Panama’s Territorial Tax System

The main advantage of a Panama IBC is exemption from tax on income from foreign sources. This means that profit earned outside Panama is not subject to corporate tax. However, the company is obliged to pay an annual franchise tax and government fees.

CRS and Tax Transparency for Panama IBC

Since 2018 Panama has joined the Common Reporting Standard (CRS), which obliges companies to disclose information about beneficiaries and financial transactions at the request of foreign tax authorities. This has increased transparency and reporting requirements.

Thus, increased transparency requirements and the integration of CRS procedures have become an integral part of effective work with Panamanian corporate structures.

Tax Optimization with Panama IBC: Strategies and Methods

Panama IBC remains an effective tool for international tax planning, especially for structuring cross-border transactions, managing funds, and intellectual property. At the same time, it is important to consider risks: tightened control, restrictions on activities in certain areas, and reporting requirements.

Corporate governance and compliance in Panama IBC

Corporate governance and compliance in Panama IBC provide transparency, stability and legal protection for business at the international level. Proper organization of Panama IBC management includes a clear division of roles, compliance with corporate standards and legal requirements, as well as measures to maintain corporate identity and ensure compliance.

Management organization of Panama IBC

The corporate structure of a Panama IBC includes directors, shareholders and the secretariat. Maintaining registers of shareholders and directors is a mandatory requirement, and the legal liability of directors is enshrined in law.

AML and KYC requirements for Panama IBC

AML (Anti-Money Laundering) policy and KYC (Know Your Customer) procedures are key elements of compliance for Panama IBC. Each company is required to identify clients, monitor transactions and maintain internal reports.

Panama IBC reporting in 2025

Since 2025, new requirements for financial reporting have been introduced: Panama IBCs are required to maintain accounting records, file annual reports, and undergo audits at regulators’ request. Simplifications apply to low-turnover companies, but reporting for international structures is becoming increasingly detailed.

Practical tips for entrepreneurs

Practical tips for entrepreneurs are especially relevant if you want to effectively use international tools to grow your business and reduce tax burden. Below are step-by-step recommendations that will help organize the registration of a Panama IBC company and avoid common mistakes at the start.

Panama IBC registration

- Define the goals and business model of the Panama IBC (trade, investments, e-commerce).

- Prepare the package of incorporation documents: Articles of Incorporation, minutes, beneficiary information.

- Check the company name in the public register.

- Choose a registered agent with a license and experience.

- Conduct KYC/AML checks on all participants.

- Submit documents and pay government fees.

- Obtain the certificate of registration and open a bank account.

- Implement registry, accounting and compliance procedures.

How to choose a registered agent and partner

It is also important to take into account the requirements for financial monitoring and reporting, which we will consider in the next section.

Advice on AML, KYC and tax reporting

- Implement automated KYC procedures.

- Regularly update the register of beneficiaries.

- Maintain internal audit and reporting.

- Use digital platforms to manage corporate risks.

How to protect the privacy of assets and owners?

Scaling business through a Panama IBC in Europe, Asia, and the CIS

Panama IBC integrates with global markets, supports digital commerce and blockchain projects, allows structuring cross-border investments and managing funds. For companies from the CIS and Asia, Panama IBC opens opportunities to enter EU and Middle Eastern markets.

Risks and limitations of Panama IBC

- Tightening of international transparency standards (CRS, AML).

- Restrictions on activities in certain areas (finance, crypto).

- Requirements for reporting and auditing.

- Possible consequences of the Panama Papers and legislative reforms.

Frequently Asked Questions about Panama IBC

- Articles of Incorporation, minutes, beneficial owner information, proof of address, KYC forms.

- For financial, crypto, and payment services: separate licenses that the COREDO team helps obtain.

- Fund structuring, asset management, tax optimization.

- Flexible corporate structure, ability to integrate with digital platforms, data protection and confidentiality.

- Assess the license, experience, compliance expertise, and transparency of processes.

- Mandatory maintenance of the register, regular updates, compliance with Law 129 of 2020.

- Tightening of transparency requirements, introduction of a beneficial owners register, increased compliance standards.