Nikita Veremeev

28.09.2025 | 6 min read

Updated: 28.09.2025

By 2025 more than 80% of international companies in the EU and Asia had already integrated digital technologies into corporate governance, and according to McKinsey, the digitization of corporate governance can increase decision-making speed by 35% and reduce operating costs by up to 25%[EN: McKinsey, 2024][EN: OECD, 2023].

But why do some companies use digital corporate governance as a growth lever while others face barriers and risks? How can you ensure not only technological transformation but also legal integrity, transparency and the strategic resilience of the business in the digital economy?

When I, together with the COREDO team, developed a strategy for a large holding with offices in the EU and Asia, we faced a classic challenge: how to unify heterogeneous business processes, meet AML and compliance requirements, ensure digital business transparency and at the same time not lose management flexibility?

The answer was a comprehensive approach to digital corporate governance.

Digital corporate governance is not just the implementation of new IT solutions. It is a systemic transformation of corporate procedures based on digital technologies, standards and automation, which enables companies to effectively manage corporate structure, shareholder capital, risks and compliance in the digital economy.

At the core are the digitization of corporate governance, electronic corporate documents, digital corporate policies and transparency of all managerial decisions.

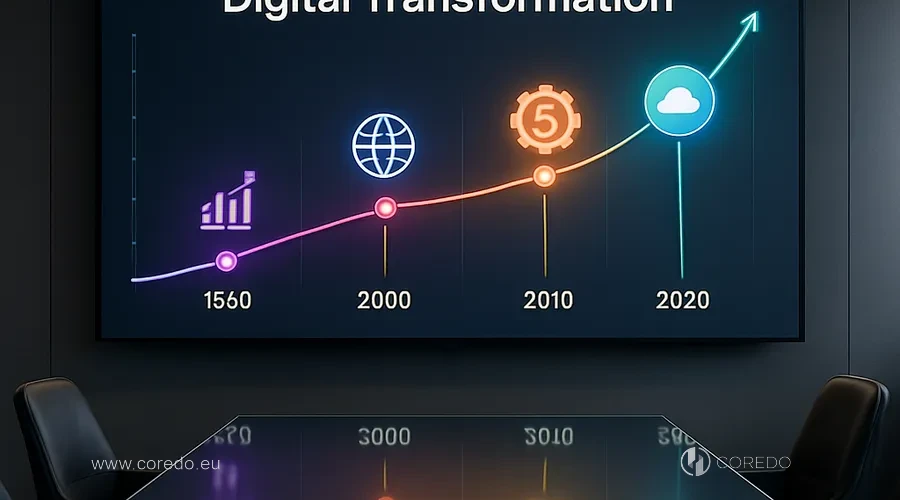

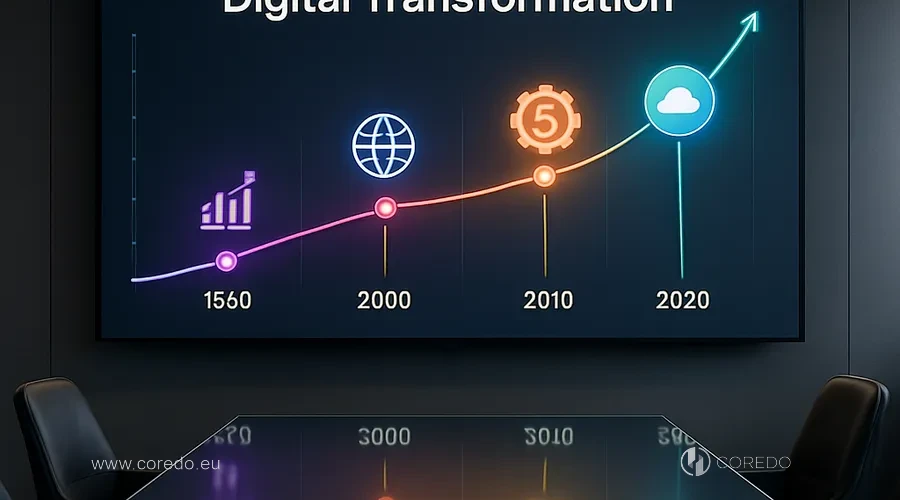

Historical stages and drivers of the digitization of corporate governance

The evolution of digital corporate governance went through several key stages:

- Automation of individual business processes (ERP, electronic documents).

- Integration of digital platforms for managing the board of directors, shareholders and corporate committees.

- Transition to hybrid governance models, where digital integration of business processes ensures synchronization of distributed teams and business units.

- Use of artificial intelligence, big data and blockchain for digital audit, control and transparency of corporate decisions[EN: Deloitte, 2024][DE: BCG, 2023].

COREDO’s practice confirms: the drivers of digital transformation are not only technological progress, but also the tightening of international corporate governance standards, increased requirements for AML and compliance, as well as the need to manage risks and corporate responsibility in the context of globalization.

Digital corporate governance: tools and components

Automation of corporate governance and digitization of business processes

The implementation of digital tools for companies begins with the automation of corporate governance and the digitization of business processes. Solutions developed at COREDO allow clients to implement decision-making automation, digital integration of business processes and build digital enterprise governance based on modern BPM and ERP systems.

For international holdings, automation of corporate governance becomes a critical factor for scaling and risk management. For example, for a COREDO client in the fintech sector, we implemented digital platforms that allowed automating control of corporate procedures, reducing the human factor and ensuring digital synchronization of business units across different jurisdictions.

Virtual board meetings and electronic shareholder voting

The digitization of corporate governance is impossible without the transition to virtual board meetings and electronic shareholder voting. This not only speeds up processes, but also provides digital identification of participants, protects the digital rights of shareholders and minimizes legal risks.

The COREDO team implemented projects to deploy digital platforms for remote board management, which is especially relevant for companies with distributed structures. Electronic corporate meetings and electronic shareholder voting increase owner engagement and the quality of corporate dialogue, as well as ensure the legal integrity of procedures in accordance with international standards.

Digital reporting and data management in the corporation

Digital reporting for business and data management in the corporation are key elements of digital corporate governance standards. COREDO’s solutions in this area include the implementation of digital reporting standards (IFRS, XBRL), automation of data preparation and verification, as well as building a digital trail of management decisions for transparency and audit.

In one of COREDO’s cases for a holding with offices in the EU and Singapore, we integrated digital platforms for corporate reporting management, which allowed the client not only to meet regulatory requirements but also to increase the speed of report preparation by 40%.

Innovative technologies: AI, blockchain, cloud solutions, big data

The implementation of artificial intelligence in corporate governance, blockchain for corporate governance, cloud solutions for the board of directors and the integration of big data into management is no longer futurology, but a practice that the COREDO team implements

for clients.

AI enables automation of corporate risk analysis, detection of anomalies in managerial decisions, and enhancement of the company’s digital resilience. Blockchain ensures immutability of electronic corporate documents and transparency of transactions. Cloud solutions simplify access to corporate data for distributed teams and provide cybersecurity for corporate data at the level of international standards[EN: Gartner, 2023][JP: Nikkei, 2024].

Digital governance for international companies

Improving business efficiency and agility

Digitalization of corporate governance enables companies with an international structure to increase business efficiency and agility through automation of corporate procedures, digital enterprise management, and cost optimization. COREDO’s practice shows that a company’s digital resilience is directly related to the level of automation and digital integration of business processes.

In COREDO’s case for a European group of companies, implementing digital platforms reduced the time for approving internal decisions from weeks to hours, increased process transparency, and lowered operational expenses by 18%.

Transparency, control, and protection of shareholders’ interests

Corporate governance in the digital economy requires not only efficiency but also maximum transparency, control, and protection of shareholders’ interests. Digital equity management, electronic corporate documents, and digital business transparency are tools that allow shareholders to monitor corporate decisions in real time.

COREDO’s solutions for digital deal support and electronic document management ensure legal integrity and transparency at all stages of corporate procedures, which is especially important for companies operating across multiple jurisdictions.

Reducing operational and legal risks

Digital risk management, digital deal support and digital compliance management allow minimizing operational and legal risks. Implemented COREDO projects show that digital compliance and AML provide not only compliance with international standards but also a reduction in the likelihood of errors related to human factors.

As part of supporting M&A transactions in the EU and Asia, the COREDO team implemented digital corporate risk scenarios, which enabled the client to respond promptly to changes in regulatory requirements and provide digital business transparency for investors.

Legal compliance in corporate governance

Electronic corporate documents and virtual meetings: legal requirements

The transition to electronic corporate documents and virtual board meetings requires taking into account the specifics of legislation in each jurisdiction. COREDO’s solutions are always built on a deep analysis of the digital transformation of corporate legislation, the company’s digital policies, and regulations.

For example, the Czech Republic and Estonia have progressive rules for electronic corporate meetings and digital identification of participants, while the United Kingdom and Singapore pay special attention to the legal force of electronic signatures and the storage of corporate documentation in the cloud. The COREDO team ensures the legal integrity of all procedures by integrating the company’s digital policies and regulations into the client’s corporate structure.

Digital compliance and AML: compliance with international standards

Digital compliance management, digital compliance and AML are key elements of corporate resilience in the digital economy. COREDO’s solutions for digital deal support and automation of compliance procedures allow clients to meet international standards of the FATF, the EU and MAS (Singapore), as well as digital reporting standards.

In one of COREDO’s projects for a fintech company in Slovakia, we implemented digital compliance and AML based on an automated platform, which enabled the client to undergo Licensing and audits without remarks from the regulator.

Cybersecurity of corporate data

Cybersecurity of corporate data is one of the main challenges of digitalizing corporate governance. COREDO’s solutions include digital audit and control, digital identification of participants, and multi-layered protection of corporate systems.

In COREDO’s practice for clients in the EU and Asia, particular attention is paid to building cybersecurity systems based on international standards ISO/IEC 27001, implementing SIEM and SOC for incident monitoring, as well as regular digital audits of the company.

Digital corporate governance: cases and solutions

Best practices for digitalizing corporate governance in the EU and Asia

COREDO’s experience in the EU and Asia shows that successful digitalization of corporate secretary functions, implementation of a digital corporate secretary, and digital corporate committees enable companies not only to speed up corporate procedures but also to ensure transparency and control at all levels of management.

In the case for an Estonian company, the COREDO team implemented a digital platform for managing corporate committees, which allowed the client to automate the preparation and storage of electronic corporate documents and improve interaction efficiency between owners and management.

Integration of digital platforms for managing the board of directors and shareholder meetings

Digital management platforms and digital solutions for managing shareholder meetings online are becoming the standard for international companies. COREDO’s solutions for integrating digital tools for remote board management allow clients to hold electronic corporate meetings, electronic shareholder voting, and provide digital deal support in real time.

Metrics and KPIs of digital corporate governance effectiveness

Assessing the effectiveness of digital corporate governance requires implementing digital management performance metrics and digital reporting for the business. COREDO’s practice uses the following KPIs:

| Metric/KPI |

Description |

Measurement tools |

| Decision-making speed |

Average time from initiation to execution |

BI systems, corporate portals |

| Shareholder engagement level |

Share of active voting participants |

Electronic voting platforms |

| Share of automated business processes |

% of processes implemented through IT |

ERP, BPM systems |

| Number of cybersecurity incidents |

Registeredincidents for the period |

SIEM, SOC |

| Compliance with regulatory standards |

Percentage of successful audits |

Compliance control systems |

Risks of digitalizing corporate governance

Technological and organizational barriers

The digitalization of business processes and the automation of corporate governance require not only investments in IT, but also restructuring of the organization, changes in corporate culture, and integration of new digital standards. COREDO’s experience shows that digital integration of business processes and a company’s digital resilience are possible only with the support of top management and systematic staff training.

Legal and compliance risks in international scaling

Scaling digital deal support and digital compliance management across different countries involves risks of mismatched regulatory requirements, conflicts of interest between shareholders and management, as well as the need to manage ESG factors. The COREDO team develops the company’s digital policies and regulations taking into account the specifics of each jurisdiction.

Practical recommendations for minimizing risks

To minimize the risks of digital governance, COREDO recommends:

- Carry out regular digital audits and digital controls of the company.

- Implement digital business transparency at all stages of corporate procedures.

- Integrate digital corporate governance standards and digital scenarios of corporate risks into the corporate strategy.

Digital corporate governance – implementation

Stages of implementing digital corporate procedures

The solution developed by COREDO proposes the following algorithm:

- Analysis and digitalization of business processes taking into account international standards.

- Automation of corporate governance using modern BPM and ERP systems.

- Digital integration of business processes and digital synchronization of business units.

Choosing digital platforms and management tools

The choice of digital platforms for management and digital tools for companies should be based on an analysis of corporate structure, compliance requirements, and the specifics of the jurisdiction. COREDO’s practice confirms the effectiveness of implementing digital corporate committees and a digital corporate secretary to manage corporate procedures.

Organizing staff training and adapting corporate culture

Digital business transformation is impossible without staff training and adapting corporate culture to the new standards of corporate governance in the digital economy. COREDO’s solutions include training programs on a company’s digital resilience, digital personnel management, and the implementation of digital corporate governance standards.

Conclusions and advice for business

Summary recommendations for entrepreneurs and executives

- Implement digital corporate governance as a strategic tool for growth and resilience.

- Use digital business transformation to increase transparency, efficiency, and control.

- Integrate digital business transparency and the company’s digital resilience into the corporate strategy.

Checklist for implementing digital corporate governance

- Conduct a digital audit and control of current corporate procedures.

- Implement digital tools for companies and digital support for transactions.

- Ensure compliance with digital corporate governance standards and AML requirements.

Proceed to answers to the most pressing questions from entrepreneurs.

Entrepreneurs’ questions, FAQ

How to register a company in the EU or Asia taking digital requirements into account?

company registration in the EU or Asia requires consideration of electronic corporate documents, digital identification of participants, and compliance with digital reporting standards. COREDO’s experience shows that in Singapore, the Czech Republic, Estonia, and Cyprus the digitalization of corporate procedures has already become standard.

How to ensure AML and compliance when digitalizing governance?

Digital corporate governance should include automated digital compliance and AML systems, integration with international registries and transaction monitoring platforms. COREDO’s solutions allow clients to undergo licensing and audits without remarks from regulators.

Which digital tools should you choose to manage the board of directors?

For remote management of the board of directors, cloud solutions, digital management platforms, and shareholder electronic voting tools are optimal. COREDO’s practice confirms the effectiveness of integrating such platforms for companies with a distributed structure.

How to ensure cybersecurity of corporate data?

Cybersecurity is achieved through the implementation of digital audits and controls, multi-layered data protection, regular incident monitoring, and staff training. COREDO’s solutions are built on the international standard ISO/IEC 27001.

How does digitalization affect the role of the corporate secretary and the functions of committees?

The digitalization of corporate governance transforms the functions of the corporate secretary, moving them into a digital format—from maintaining electronic corporate documents to automating interactions with corporate committees and shareholders. COREDO’s experience shows that the digital corporate secretary becomes a driver of transparency and efficiency in corporate procedures.