In this article, we intend to make a compelling case regarding the current macroeconomic environment and its potential benefits for the banking sector. We strongly believe this is a golden opportunity for banking entrepreneurs to pursue their aspirations and apply for a banking license. The numbers show that the present economic climate is more conducive to the banking industry when compared to the past five years. Therefore, we urge you to seize this opportunity and turn your banking dreams into a reality! We will provide a succinct overview of the key metrics and underlying factors driving this opportunity so that you can make an informed decision. Let’s delve into the details together!

Table of Contents:

- Inflation, Interest Rates, and Bond Yields in 2022-2023

- The Benefits of Higher Interest Rates and Yields for Banks

- 2.1 Recent Headlines

- 2.2 Empirical Evidence

- 2.3 The Case of Silicon Valley Bank (SVB)

- Correlation Between New Banking Licenses and Short-Term Rates: What Entrepreneurs Should Know

- How COREDO Can Assist You in Capitalizing on the Current Economic Climate

Inflation, Interest Rates, and Bond Yields in 2022-2023

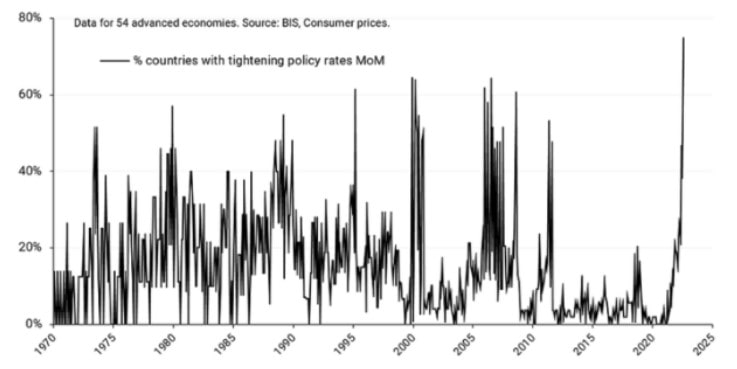

The year 2022 was characterised by a turbulent landscape for interest rates. The increase in short-term interbank interest rates witnessed a coordinated move by the central banks of advanced economies, which was unprecedented since the 1970s. Previously, none of the major countries had implemented policies that would lead to an increase in their respective policy rates. However, this scenario shifted significantly, with 43 out of the 57 major countries (accounting for 75%) raising their policy rates (as indicated in the graph below).

Source: Bank of International Settlements, Central bank policy rates

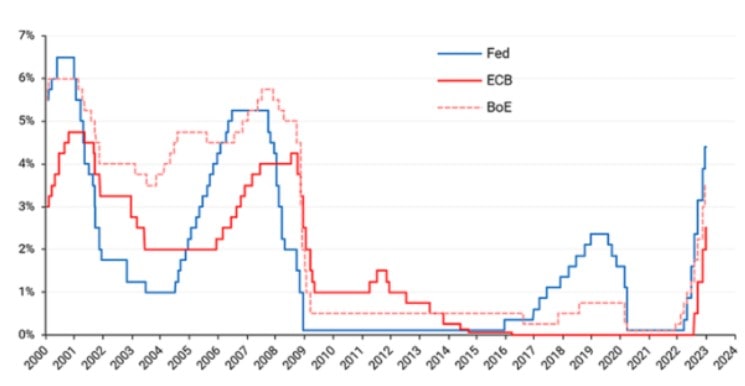

In March 2021, the central banks of Brazil, Denmark, Russia, and Turkey initiated the trend of raising interest rates with an increase of 0.75%, 0.1%, 0.25%, and 2.0%, respectively. The next month, Iceland followed suit with a 0.25% increase, and in May 2021, the Czech Republic, Mexico, and Hungary increased their rates by 0.25%, 0.25%, and 0.3%, respectively. The trend continued with other central banks joining later. The Federal Reserve of the United States (USA) increased the Fed funds rate by 0.25% in March 2022, while the European Central Bank (ECB) raised the MRO rate for the first time with a 0.5% increase in July 2022. The policy rates for the ECB, the Federal Reserve, and the Bank of England are illustrated in the figure below.

Source: BIS, Policy rates

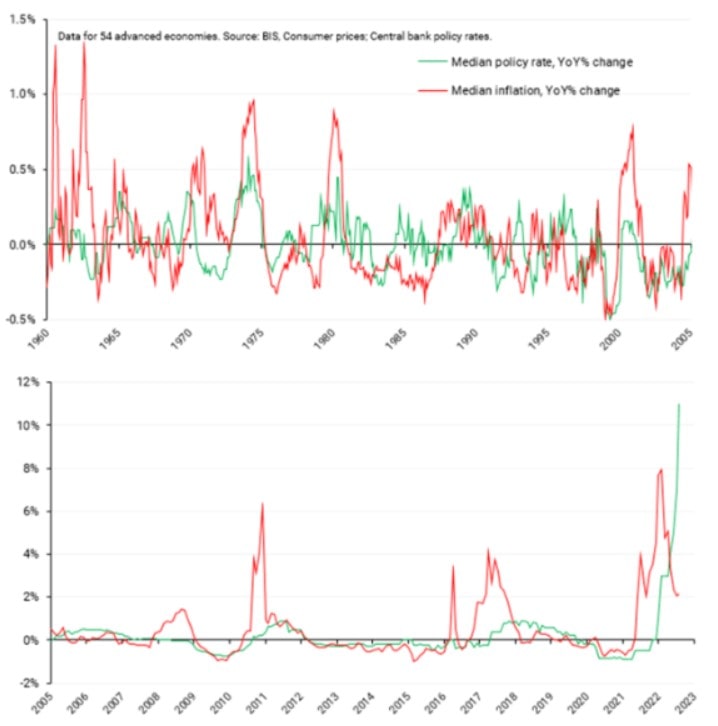

The reason behind the increase in short-term interest rates by central banks is the rise in consumer price index (CPI) inflation, which is usually countered by central banks in a countercyclical manner. This correlation is depicted in the graphs below. The first graph illustrates the percentage of countries with escalating inflation and tightening (increasing) policy rates. The correlation between the two is apparent.

Source: Bank of International Settlements, Central bank policy rates

The following two graphs depict the progression of the median policy rate shift among these 54 economies, as well as the median inflation change. Interestingly, it appears that in the most recent period (as indicated by the second graph), central banks are responding more to previous inflation rates rather than inflation responding to previous interest rate decisions made by central banks.

Source: Bank of International Settlements, Central bank policy rates

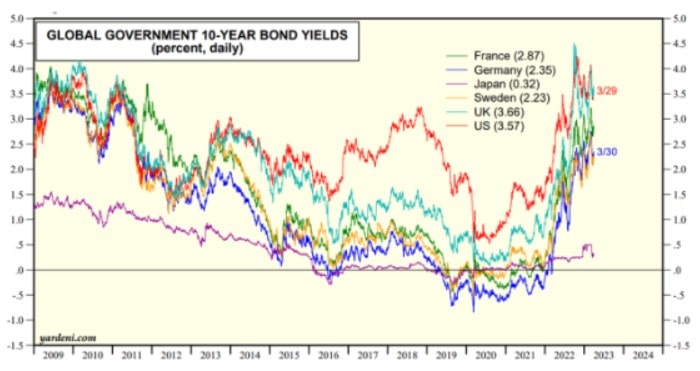

The surge in inflation has triggered a sharp rise in bond yields in several countries, as is typically observed. As of the end of March 2023, the yields on bonds from significant advanced economies, excluding Japan, hover in the range of 2-4%.

Source: Yardeni Research

The Benefits of Higher Interest Rates and Yields for Banks

The following sections present recent headlines and empirical evidence that support this claim.

Recent headlines

As evidenced by headlines in the financial news, the current rise in interest rates is proving to be beneficial for banks and those with banking licenses.

The ECB Financial Stability Review from November 2022 states that rising interest rates have improved the short-term profitability outlook of euro-area banks. In the United States, bank profits rose by 7.8% in the second quarter of 2022 from the previous quarter, with the growth attributed to the rise in interest rates and expansion of loan balances, as reported by Investopedia in September 2022. FitchRatings reported in June 2022 that the profitability of most UK banks is expected to strengthen due to the rising interest rates, with their funding costs expected to increase less than their lending rates. Deutsche Bank also reported a big jump in profit in October 2022, despite the slump in deal-making. However, as ABC News Australia reported in November 2022, rising interest rates are a double-edged sword, with potential risks to borrowers and banks alike.

According to the Global Banking Annual Review 2022 by McKinsey, bank profitability has reached its highest level in 14 years, with expected returns on equity ranging from 11.5% to 12.5%.

This growth is attributed to a significant increase in net margins, which in turn is due to the rise in interest rates that had remained at their lowest level for a considerable time. The report highlights that global revenue increased by $345 billion in the banking industry, indicating that the rise in interest rates has had a positive impact on the sector’s profitability.

According to research by Deutsche Bank in November 2022, the European banking sector is experiencing a period of positive impact, which is described as a “sweet spot”. This is due to interest rate increases by central banks in most advanced economies and strong credit growth, leading to increased revenues. Though loan loss provisions have started climbing, they remain relatively low.

While growth in administrative expenses, individual banks’ tax and litigation payments, as well as Russia-related losses have reduced net income, the industry is still expected to have a decent full-year result. The report also suggests that higher-for-longer interest rates may support banks’ business prospects in the medium term.

Empirical evidence

According to a study conducted by Kohlscheen, Murcia and Contreras in 2018, higher long-term yields and a steeper domestic yield curve have a positive impact on bank profitability in emerging markets. The domestic yield curve is the difference between long-term yields and short-term interest rates, and a steeper yield curve indicates that long-term interest rates are higher relative to short-term rates. This study supports the idea that higher interest rates can benefit banks by improving their profitability in emerging markets.

English et al. (2012) found that a 100 basis point increase in interest rates can increase the median bank’s net interest income relative to assets by nearly 9 basis points. This indicates that banks can benefit from higher interest rates, as it can increase the spread between the interest rates they pay on deposits and the interest rates they earn on loans, leading to higher profits.

Borio, Gambacorta, and Hofmann’s (2015) study found that there is a positive correlation between the level of short-term rates, the slope of the yield curve, and the banks’ return on assets (ROA). They discovered this by analysing data from 109 large international banks based in 14 major advanced economies from 1995 to 2012. Additionally, they concluded that banks’ profitability is negatively affected by unusually low short-term interest rates near zero or slightly negative, especially if combined with a flat yield curve.

According to an FDIC study, it is conventional wisdom that the median net interest margin (NIM) for the typical community bank tends to increase when short-term interest rates increase and decrease when short-term interest rates decrease. This finding supports the view that higher interest rates are good for bank profitability and those having banking licenses.

Claessens, Coleman, and Donnelly’s (2017) study, which analysed a sample of 3,385 banking license holders from 47 countries between 2005 and 2013, found that a 1% drop in interest rates leads to a decrease of 0.08% in net interest margin (NIM). The effect is more pronounced at low rates, with a 0.2% decrease in NIM. The authors also observed that low rates have an adverse impact on bank profitability but to varying degrees.

Meanwhile, a Bank for International Settlements (BIS) report (2018, p. 11) confirms the positive correlation and statistically significant relationship between banks’ NIM and the lagged variables of the three-month interest rate and the slope of the yield curve. Notably, the report also shows that the effect is small in the short term but significant in the long term. Additionally, Klein (2020) discovered that the short-term interest rate positively correlates with the retail margins of euro-area banks. However, she noted that the positive relationship between the short-term rate and NIM is only valid when the interest rate is less than 2%.

Source: Klein (2020)

Hoffman et al. (2018, p. 27) suggest that contrary to popular belief, approximately half of the banks in their study would actually benefit from a rise in interest rates in terms of both net worth and income. They attribute this phenomenon to a “reverse maturity transformation”, which occurs for banks that hold variable-rate assets funded by “sticky” sight deposits.

Foos et al. (2022) report that banks’ stock prices tend to benefit from positive level shifts and steepening, as well as stronger-curved yield curves, on average.

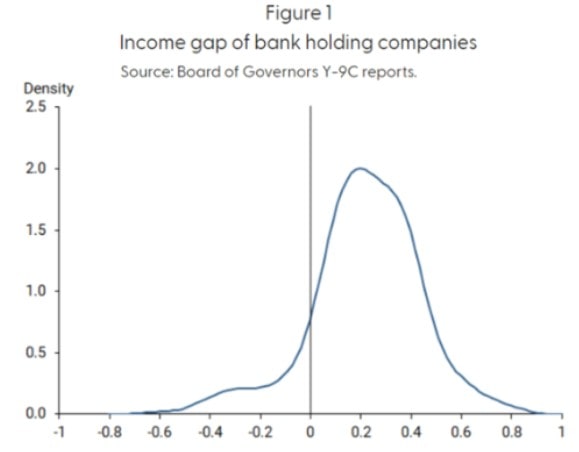

Paul (2022) discovered that most United States banks with a banking license have a positive income gap, representing the difference between assets and liabilities that mature or reprice within 12 months. This gap indicates how a bank’s net interest income reacts to fluctuations in interest rates. Many banks hold adjustable-rate loans, while their liabilities are non-maturing deposits, such as current or demand deposits and savings accounts, which have slow-to-adjust administered rates. Consequently, the positive income gap value results from this fact.

Source: Paul (2022)

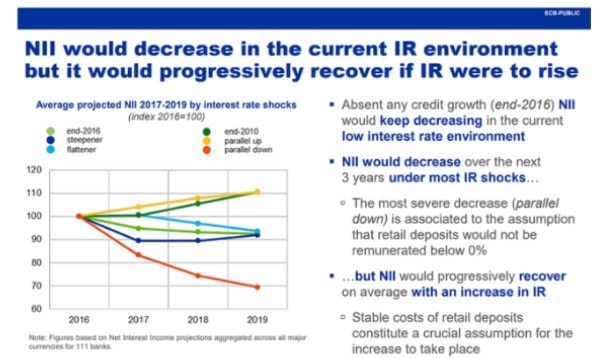

The European Central Bank’s 2017 analysis of interest rate risk in the banking book (IRRBB) among 111 large euro area banking license holders provides further evidence. The analysis showed that in a scenario of both short- and long-term rates going up (“parallel up”), banks’ net interest margin (NIM) would improve, while in a scenario where both rates went down (“parallel down”), the net interest income (NII) would worsen.

Source: ECB sensitivity analysis of IRRBB — stress test 2017

Banking professionals are well aware of the positive effects of rising interest rates on their profitability, as evidenced by a survey conducted by the European Banking Authority (EBA) among 60 major euro-area banking license holders. The graph below shows the survey results, indicating that 77% of respondents estimated a “rather positive” impact on their profitability over the following 6-12 months, while 10% believed it would be “very positive”. Only 8% of respondents thought the impact would be “rather negative”. The positive-to-negative response ratio was 10.8-to-1, further highlighting the industry’s sentiment towards the relationship between rising interest rates and bank profitability.

Source: EBA Risk Dashboard, Risk Assessment Questionnaires (RAQs), Spring 2021, published Q1 2022

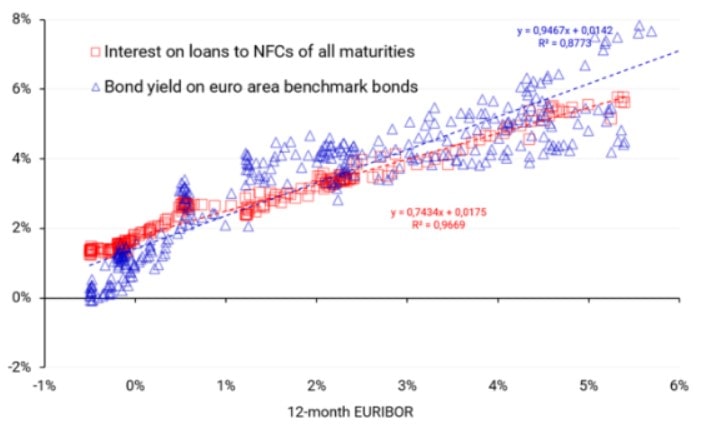

The reason why banks benefit from rising interest rates is quite simple. When short-term interest rates increase, the spread between the rate banks charge on loans and the rate banks pay on deposits also increases, which leads to an increase in net interest margin (NIM). As shown in the graph below, the spread is not constant, and it rises with short-term interest rates. This is a well-established fact in the banking industry, and it’s important to note that banking license holders have market power in retail deposit markets. This limited pass-through of market rates to deposit rates also contributes to the increase in NIM. (Hoffmann et al., 2018, p. 12; Kirti, 2017, p. 13).

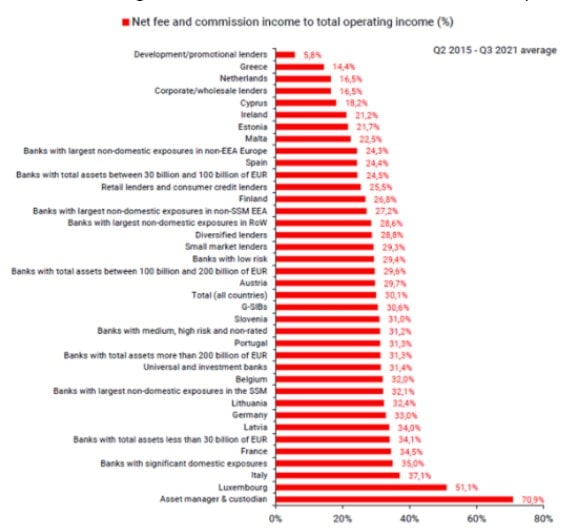

The loan-deposit spread (LDS) can be calculated as the difference between the interest rates on loans and the interest rates on deposits. Specifically, for non-financial corporations, it is the difference between interest rates on loans of all maturities and the interest rates on overnight deposits held by non-financial corporations. For households, it is the difference between interest rates on loans for house purchases with an original maturity more significant than 10 years and interest rates on overnight deposits held by households. The data source for this calculation is the ECB Statistical Data Warehouse, MIR: MFI Interest Rate Statistics. Since fee and commission income accounts for less than 30% of the euro-area banking license holders’ revenue, changes in interest rates have a dominant impact on their profitability.

Source: ECB Statistical Data Warehouse, SUP: Supervisory Banking Statistics

The relationship between the rate charged on loans to non-financial corporations and the yield on euro area benchmark bonds is depicted below, showing a close correlation between the two. Hence, the same principles that apply to the loan-deposit spread (LDS) also apply to bond yields.

Just to clarify, “NFCs” is an acronym that stands for “non-financial corporations”.

The data referred to in the previous message are for the euro area, and the source is the ECB Statistical Data Warehouse.

The Case of Silicon Valley Bank (SVB)

It’s important to note that interest rate risk is relevant not only to traditional commercial banks but also to other financial institutions such as savings banks, cooperative banks, investment banks, and asset managers. All of these institutions can be impacted by changes in interest rates, as they hold assets and liabilities that are sensitive to interest rate movements.

As for Silicon Valley Bank (SVB), it’s an interesting case study of the importance of managing interest rate risk. It’s worth noting that the losses suffered by SVB were due to a mismatch between the maturities of its assets and liabilities rather than simply due to rising interest rates. The fixed-rate government bonds that SVB held were longer-term assets, while the variable-rate deposits used to fund them had shorter-term maturities. This meant that SVB was exposed to interest rate risk, as rising interest rates made its longer-term assets less valuable. When SVB was forced to sell its bond positions before their maturity date, it could not recoup the total value of those assets.

This highlights the importance of managing interest rate risk by carefully matching the maturities of assets and liabilities. It also underscores the need for financial institutions to have robust risk management practices in place to identify and mitigate potential risks.

Correlation Between New Banking Licenses and Short-Term Rates: What Entrepreneurs Should Know

Entrepreneurs who are interested in establishing new banks are likely to be well-informed about the impact of interest rates on the banking industry and may be more likely to seek new charters when interest rates are high. This is because rising interest rates create a more favorable environment for banks to generate profits, as they can increase their loan rates while keeping deposit rates low, which leads to a wider net interest margin. Conversely, when interest rates are low, banks may struggle to generate profits, which could discourage new entrants into the market.

Below is a graph illustrating the correlation between the number of new banking licenses granted in the United States and the Federal Reserve’s federal funds rate. Entrepreneurs perceive an increase in interest rates as a favourable economic environment to operate a profitable bank. The evidence supporting this is demonstrated in the graph by the spike in new banking licenses granted in 1981-1982, despite the fact that there were two consecutive recessions in the United States from 1980-1982. This spike occurred as the Federal Reserve’s Chairman, Paul Volcker, increased the federal funds rate to 20% in June 1981.

The data source for this graph is the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve Economic Data (FRED)

Jones, Myers, and Wilkinson (2022, p. 38) explain that the issuance of new banking licenses rises with increased interest rates since higher interest rates lead to a boost in banks’ net interest margins. This is the primary source of earnings for small banks. Conversely, the number of charters decreases when interest rates decline, which compresses net interest margins.

How COREDO Can Assist You in Capitalizing on the Current Economic Climate

It is widely known that obtaining a banking license and establishing a bank is a time-consuming and capital-intensive endeavor that requires a significant amount of documentation and knowledge of banking regulations. The process typically takes 18-24 months, requires at least €30mn in initial capital (including €2.5mn in start-up costs), and involves the preparation of over 2,000 pages of documentation, including compliance with regulations such as the CRR, CRD IV, and EBA Guidelines. It is also generally necessary to seek the assistance of specialised financial practitioners with experience in banking licensing and regulations.

At COREDO, we have a wealth of knowledge and experience in this area and can assist you in obtaining a banking license in most EEA+UK jurisdictions. We offer a free consultation to identify and analyse your options for obtaining a license and provide guidance on the regulatory requirements associated with the banking licensing process in the most appropriate jurisdiction for your needs. Contact us today to learn more.