Financial technology’s success differs significantly, but it has shifted from the periphery of European finance to its centre. The economic gains would be significant if all nations could compete with the best of the best in the area.

The mentioned industry has been severely impacted by the deteriorating macroeconomic situation in Europe and throughout the world, with valuations decreasing and access to capital becoming increasingly challenging. However, when examined over the long run, financial technology companies in Europe continue to grow in power and importance to consumers and the economy. At a minimum, one fintech company is among the top five banks in each of the seven main European nations in terms of gross domestic product (GDP).

Powerful financial institutions provide clients with additional options and flexibility.

In numerous European nations, the financial industry environment is already being modernised with huge kudos to the competition they offer to bank institutions. We concentrate on three crucial facets of Europe’s fintech industry in this piece and the comprehensive research that goes along with it: starting, funding, and scaling, or the ability of fintech to get started, how simple it is for them to obtain finance, and how effectively they can expand and succeed.

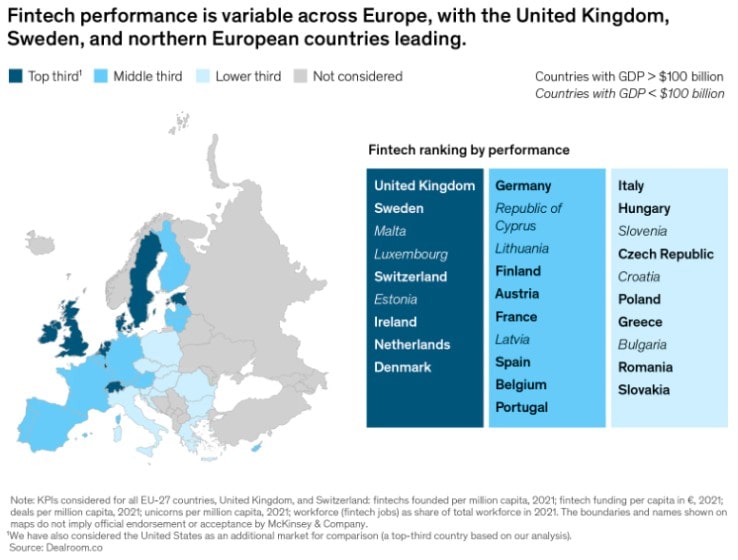

Research shows that fintech activity is expanding across all of Europe. However, we also uncover significant discrepancies between the top one-third and the bottom two-thirds of fintech ecosystems in terms of maturity and performance (Figure 1). The United Kingdom and Sweden, in particular, stood out for their outstanding financial technology ecosystem performance.

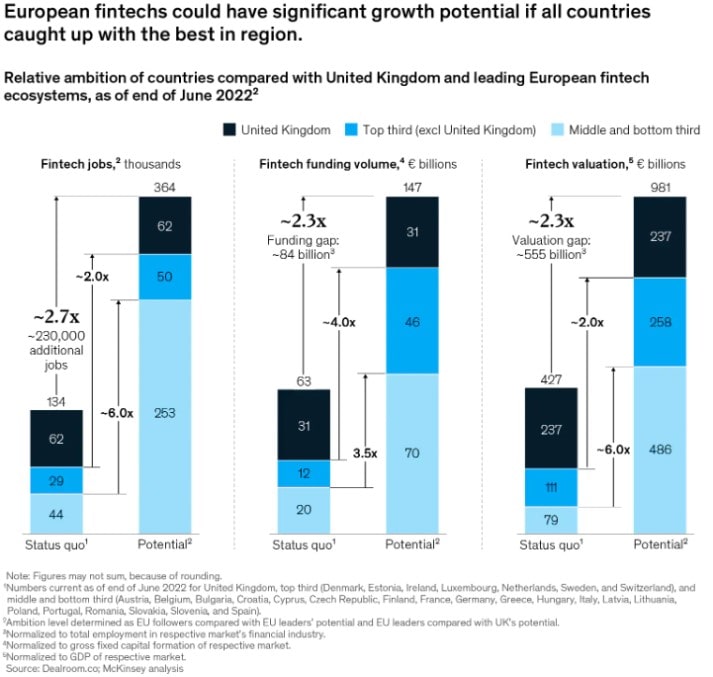

Figure1.

The advantages might be significant if financial services institutions across all of Europe were able to function at the same level as the finest in the area. Financial technology employment in Europe would increase by a factor of 2.7 to around 364,000, and financing will nearly double to almost EUR 150 billion from EUR 63 billion. Further, valuations would increase by approximately 2.3 to almost EUR 1 trillion — most likely twice the market price of the top ten European banks as of June 2022.

Fintech companies are indeed the driving force behind client happiness, innovation, and development in Europe’s financial services industry.

The financial technology industry in Europe has swiftly advanced from the periphery of the continent’s financial landscape to its centre. There is currently at least one fintech among the top five financial institutions in each of the seven major European nations by Gross Domestic Product (GDP) — France, Germany, Italy, the Netherlands, Spain, Switzerland, and the United Kingdom. Fintechs are defined as financial services organizations (except direct banks) primarily driven by digital technology, were founded after 2000, have received capital since 12 years ago, and have still not attained their full maturity.

The benefits that European fintech provides to clients, the country’s entire financial industry, the continent’s general economy, and civilization as a whole underpin this tremendous rise.

- How is it for the customers?

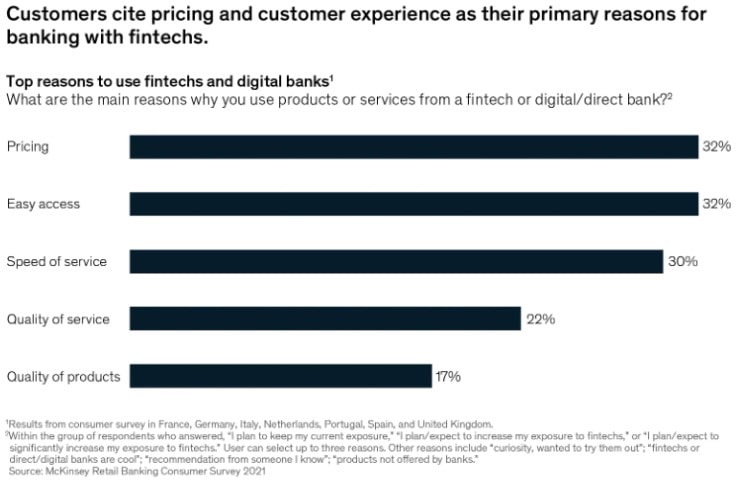

Fintechs are becoming increasingly popular since they provide value by providing improved service at reduced rates. For instance, using financial technology services to perform foreign transfers and stock transactions can result in costs that are only ten per cent (10%) of what traditional banking institutions charge. In seven major European nations, a new retail banking customer study indicated that thirty-two per cent (32%) of participants named cost as their top motivation for using fintech or virtual banks, which is the same number as those who mentioned accessibility (Figure 2).

Figure 2.

Fintech companies often provide clients with financial options they might not have had access to otherwise, such as asset classes like infrastructure funds, private equity funds, and venture capital investments that were previously solely allocated to institutions. Several digital banking companies, such as small and medium-sized businesses, concentrate on historically underserved clientele.

- How is it for the financial industry?

Fintechs act as a driver for development and innovative disruption. Fintech companies, with their speed and strength, are well suited to handle numerous emerging financial industry innovations, such as distributed ledger technology (DLT) and integrated finance. With an estimated two to six months marketing time compared to incumbent banks’ 12 to 18 months, they frequently provide new goods and services significantly more quickly. Fintechs are also persistent innovators and leaders in delivering a distinctive client experience and lean banking procedures. Nowadays, several top-tier banks in Europe depend on numerous fintech alliances in various sectors, including operational terms and payment transactions.

- How is it for the economy, as a whole?

Fintech firms are significant potential development drivers. Furthermore, in Europe, the industry ramped up its recruiting sector dramatically at a time when incumbent banks in Europe have been cutting their workforces, creating over 134,000 opportunities throughout the continent. Six (6) active start-up hotspots like Amsterdam, Berlin, London, Lisbon, Madrid, and Paris draw international talent. From a value generation standpoint, financial technologies in Europe are estimated to be worth over EUR 430 billion as of June 2022. That exceeds the market value of the seven publicly multinational banks in Europe as of June, 2022.

Financial technology behaviour differs greatly throughout Europe

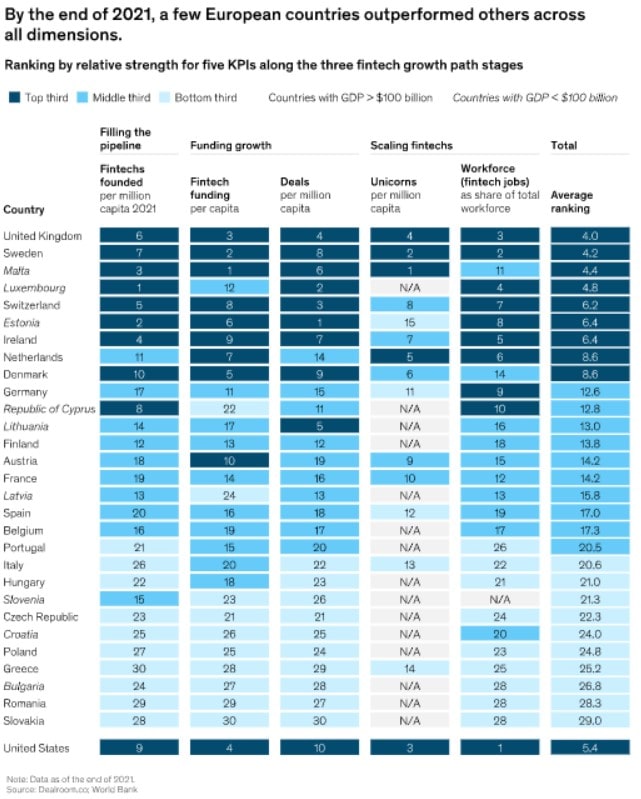

An analysis reveals significant differences among the financial technology environments in Europe. For instance, Sweden and the United Kingdom (UK) consistently outplay their European counterparts in all important performance categories. A comparison of the success of the fintech ecosystems in the European Union – twenty-seven (27) nations, the United Kingdom, and Switzerland throughout the three growth stages of starting, fundraising, and scaling were conducted in order to analyse overall performance. They were assessed using the five Key Performance Indicators (KPIs). The formation rate using the number of fintech companies per million people in 2021 was calculated.

Two KPIs were used to measure financing: the number of agreements per million people in 2021 and financial technology funding per capita in euros in that year.

The size of the fintech workforce as a percentage of the entire workforce in 2021 and the number of fintech unicorns8 per capita were the final scaling factors the researchers looked at. It was understood that these KPIs do not represent a thorough examination of all elements that may affect performance as a whole. They nevertheless reveal the main advantages and disadvantages of fintech performance.

Figure 3 summarises the performance of the fintech industry using these measures. It indicates a second tier of nations with powerful financial technology industries across most of the dimensions we study, including Switzerland, Ireland, the Netherlands, and Denmark, in addition to clearly demonstrating leadership across all dimensions by the United Kingdom and Sweden. They comprise the top third of fintech performances in Europe and the top-ranked nations.

Figure 3.

Each stage — founding, fundraising, and scaling — shows performance discrepancies.

Each stage — founding, fundraising, and scaling — shows performance discrepancies.

On completing the pipeline for fintech. There is a sizable discrepancy in the number of fintech companies per million people in a little more than fifty per cent of the European nations. In comparison, Ireland and Switzerland have thirty (30) fintech per million people, while the United Kingdom has 26 fintechs (Exhibit 4). The top five nations (those with GDPs under USD 100 billion) have twenty-five (25) fintechs per million citizens on average.

Figure 4.

On financing innovation. The largest funding per capita is seen in the European nations that do the best (Figure 5). Per capita financing is significantly lower in underperforming nations like Greece, Poland, and Romania. Hungary, Italy, Poland, and Portugal remain largely underneath their counterparts substantially because the overall amount of money is still inadequate, despite the fact that some nations have been able to boost per capita investment by as much as a factor of six over the previous three years.

On financing innovation. The largest funding per capita is seen in the European nations that do the best (Figure 5). Per capita financing is significantly lower in underperforming nations like Greece, Poland, and Romania. Hungary, Italy, Poland, and Portugal remain largely underneath their counterparts substantially because the overall amount of money is still inadequate, despite the fact that some nations have been able to boost per capita investment by as much as a factor of six over the previous three years.

Figure 5.

Compared to markets like the Netherlands and France, the financial technology investment growth rate in certain nations – like Germany, Greece, and Ireland — has slowed or declined in recent years. Combining earlier-stage (seed and series A) and late-stage (series B+) per capita investment is dominated by the United Kingdom (Figure 6). With a combined volume of over EUR 1.3 billion for early-stage fundraising and EUR 8.3 billion for delayed financing in 2021, the United Kingdom dominated the European marketing population. This accomplishment compares favourably to other nations, particularly the United States, whose gross domestic product is only approximately four times that of the United Kingdom while being almost ten (10) times larger overall.

Figure 6.

On Scaling Financial Technology. The incidence of fintech unicorns was examined as a measure to assess the capacity of European nations to develop their fintech ecosystems. With thirty-two (32) unicorns combined — four times more than France and the Netherlands, the next-highest number of unicorn-producing nations — the United Kingdom has the finest scaling record.

On Scaling Financial Technology. The incidence of fintech unicorns was examined as a measure to assess the capacity of European nations to develop their fintech ecosystems. With thirty-two (32) unicorns combined — four times more than France and the Netherlands, the next-highest number of unicorn-producing nations — the United Kingdom has the finest scaling record.

Europe versus America: A FinTech Comparison

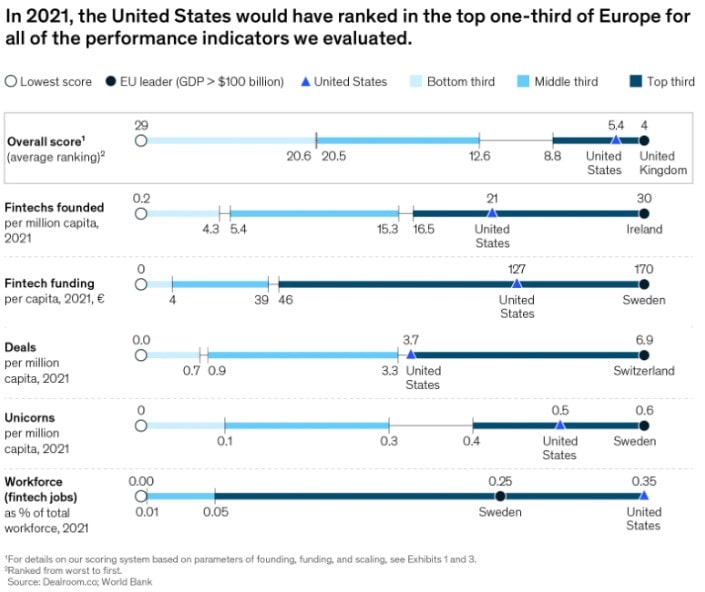

Comparing Europe and the United States by employing the same three life cycle elements of creation, funding, and scaling is beneficial (Figure 7). With strong representation in the contribution of the United States fintech companies to the economy and workforce, the United States outperforms the European average in all three components and places in the top three across all KPIs.

Figure 7.

Several elements might justify why the United States is stronger than the average in Europe. As an illustration, the United States has a sizable domestic market but only one official language and generally unified financial regulations. Taking the venture capitalist (VC) community in general, particularly in the IT sector, improving financing processes from first seed investment up to IPOs, market maturity is also stronger than in several European nations. Accessibility to financing may also be made simpler since institutional investors and US pension funds can give venture capital in prohibited methods in several European countries.

Several elements might justify why the United States is stronger than the average in Europe. As an illustration, the United States has a sizable domestic market but only one official language and generally unified financial regulations. Taking the venture capitalist (VC) community in general, particularly in the IT sector, improving financing processes from first seed investment up to IPOs, market maturity is also stronger than in several European nations. Accessibility to financing may also be made simpler since institutional investors and US pension funds can give venture capital in prohibited methods in several European countries.

However, our data shows that certain nations, such as the United Kingdom, do better than the United States at the financing stage.

Several variations in ecosystem success across Europe can be attributed to nation-specific market circumstances.

Examining the issues preventing the sector’s performance is necessary to reduce the disparity between leading European nations and those located in the lowest or middle third of the rankings. Here, we concentrate on six variables that might affect the ecosystem and for which changes in approach can have an influence both now and in the future.

- On the market’s structural and maturity aspects. These factors may be influenced by historical, cultural, and language dimensions. For instance, having a universally used language, a single currency, and unified regulations might be beneficial. How lengthy a financial technology or larger startup environment has been is one defining feature since markets evolve and adapt with time. The degree by which a newer generation of entrepreneurial founders is blossoming, who can draw on them as instructors, followers, consultants, or financiers, might be another determining factor.

- On capital’s accessibility. Financial technology financing in Europe has dramatically grown throughout the past five years, but not consistently. Only about 20% of the funds raised are used for early-stage funding. A third or more of the nations in Europe, most located in Eastern Europe, lacked delayed (series B) funding. Due to stricter laws than in the United States, significant European money pools like retirement funds and life insurance tend not to be fully utilised.

- On legal and regulatory environments. France and the Netherlands are two European nations that view their regulatory bodies as crucial development facilitators. However, there is still potential for advancement in the current regulatory frameworks that encourage the creation, expansion, and value of fintech companies. Fintech firms may find new business prospects due to European payment processing system directives for information sharing in the financial sectors. Fintechs will be able to access consumer data from all European financial players thanks to these rules, which will lead to the emergence of new approaches to business. This has occurred in the UK, a pioneer in using public information for finance.

- On acquisition and mobility. Not only for fintech companies, but Europe also has significant competency gaps that must be filled. In addition to a general lack of talent, several nations’ complex work permit procedures and visa regulations can also make it difficult to hire talent.

- On scaling and internationalisation requirements. Financial technology companies in Europe must be capable of expanding outside of their native markets in order to scale. Language barriers can exist even within one internal market like the European Union due to cultural, legal, and even monetary disparities.

- On customer transparency. The spread of fintech companies may be constrained by disparate degrees of virtual maturity, a shortage of internet connections, and other systemic issues in certain nations. Consumers might not fully comprehend concerns, such as those related to data security. Due to their greater degree of public trust than fintech firms, such problems work to the benefit of traditional financial institutions’ benefit. Administrative variations may also play a role in this. For instance, some nations have stricter rules governing consumer protection laws than others.

Finding the positive: the financial technology potential in Europe offers more employment, more finance, and greater values.

What benefits may European financial technology experience if the region’s poorer-performing nations catch up to the top three and if the upper third catches up to the United Kingdom? We have developed a framework for predicting what would emerge to financial technology employment, financing, and assessments if all of Europe’s nations reached the highest per capita levels.

The outcome of this theoretical activity is shown in Figure 8. The total number of employed people might expand by a factor of 2.7 to greater than 364,000, and the countries that are lagging behind the leaders — the “supporter” countries — could see a six-fold boost in employment. With an additional EUR 84 billion worth of investments, the amount of potential funding would increase by a ratio of nearly 2.3. The spending allocation for the upper third of European nations would increase four-fold if raised to the United Kingdom’s threshold, demonstrating the competitive intensity of the United Kingdom. Europe’s total values might increase by around 2.3 times, reaching EUR 981 billion.

Figure 8.

- A concentrated effort across six major action categories might assist European nations in catching up to giants in the fintech industry.

To catch up with the leaders, middle and low-performing nations will need a clearly defined programming objective. We wrap up by looking at a few of the strategic alternatives that European fintech companies and their shareholders might consider as they expand and strengthen the industry.

- Encourage the European Union’s economic models to align

In the European Union, progress is already toward the general simplicity and standardisation of scattered local legal rules, enabling financial technology to comprehend fundamental constitutional concepts and concentrate on local particulars. International cultural interaction may help financial companies better grasp important client demands outside of their native markets. Consumers may eventually catch up to an increasingly fully digitised way of life in the meantime.

- Promote more varied, “homegrown” investment

Policymakers and localised prominent politicians have a significant influence in determining the limitations on investment banks’ accessibility to capital investment. For instance, compared to investing in loans, they could generate larger opportunities for private equity and venture capital securities. It could help to loosen limits on the accumulation of capital organisations’ capacity to invest. For instance, only around ten per cent (10%) of transactions by German insurance companies are presently made in investment options like venturing or independent capital. Still, this proportion is over thirty per cent (30%) in the United Kingdom.

- Encourage rules and regulations with a creative outlook

The objective is to establish a legal structure that promotes the development and gives businesses the tools they need to succeed both locally and abroad, all while assuring consistency and safeguarding both capitalists and consumers. In this setting, an algorithmic collaboration intended at bolstering fintech ecosystems is particularly crucial. For fintech companies, this might particularly imply reducing the organisational complexity and costs related, adjusting regulatory standards as needed, and improving operational customer-friendliness.

- Being a draw for international talent

Banks and other financial technology institutions may contribute by providing desirable positions with great growth potential. They can also make a commitment to developing a contemporary workplace culture that caters to a variety of requirements and experiences. For many potential workers, being able to work from home without having to physically visit an office might be a great perk. Politicians and authorities may also promote contemporary business practices in their nations and improve the tax system to attract top international talent.

- Enabling the success of fintech companies in key markets

Whether all interested parties – from investors and established financial institutions to public players and government entities have their knowledge of foreign markets with the corresponding foreign laws and industry prerequisites in one centralised location, fintechs might be able to make more informed choices about their prospective customer segments.

- Expand consumer options and accessibility

Fintech companies may be capable of avoiding some compliance issues early on if they place the same emphasis on product security and stability as they do on customer experience. For instance, before investing, they might be more open about investments and the associated risk to clients, going further above current data and customer protection regulations. A Europe-wide effort might be created by political actors and policymakers to make it simpler for fintech businesses to prove their legitimacy to clients.

Financial technology has significantly altered the financial environment in Europe and is now at the centre of it. Customers will profit from the expanded options, and monetary institutions will gain from the greater competition and modernisation. This is however only the beginning; even though just a few nations will already have established themselves as European leaders in the fintech sector, the area as a whole has significant development potential. The benefits for the economy and fintechs themselves might be enormous if nations were to improve to the standard of the area’s top performers. In the upcoming months and even years, it will become crucial for all parties involved — public organisations, well-established actors in the financial institutions, and financial technology pool their resources by creating the institutional framework.