As environmental, social, and governance (ESG) concerns take centre stage in the investment world, some investors consider Bitcoin (BTC) a potential ESG investment. While the cryptocurrency has been known for its high volatility, it has also gained a reputation for being a relatively low-carbon footprint investment. This has led some to speculate that Bitcoin may be the greatest ESG investment ever.

In recent years, Bitcoin mining has come under scrutiny for its energy consumption, with many critics arguing that the process of “mining” Bitcoin requires an unsustainable amount of energy, primarily derived from coal. However, recent studies have shown that Bitcoin mining may not be as energy-intensive as once thought. In fact, a significant proportion of BTC mining relies on off-grid energy sources, including zero-emission energy.

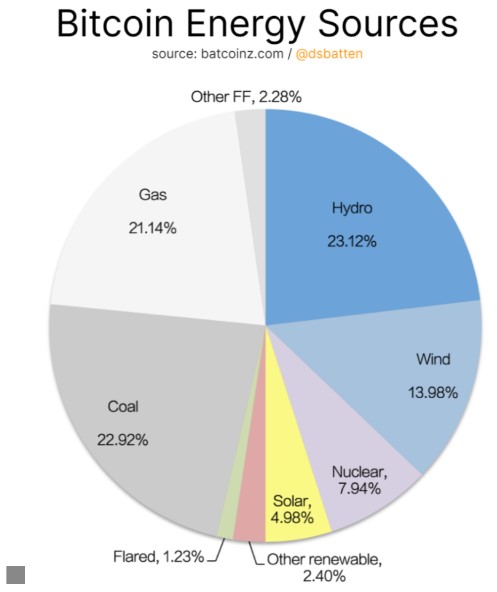

According to one study, over half of the Bitcoin network (52.2%) is powered by zero-emission energy sources. Some mining enterprises even use 90%-100% zero-emission energy, and a handful use emission-negative sources. These findings challenge the notion that Bitcoin mining relies solely on coal and suggest that the cryptocurrency may have a lower environmental impact than previously assumed.

But Bitcoin’s potential as an ESG investment goes beyond its environmental impact. The cryptocurrency has also had a significant positive impact on a global scale, particularly in underbanked regions where traditional banking systems are unreliable or non-existent. Bitcoin has enabled people in these regions to participate in the global economy, transfer money across borders, and access financial services that would otherwise be out of reach. This has the potential to improve financial inclusion and reduce poverty, making Bitcoin an attractive investment for socially conscious investors.

Of course, Bitcoin has risks, and investors should always conduct thorough due diligence before investing. But with its potential as a low-carbon, socially impactful investment, Bitcoin may be a game-changing ESG investment opportunity.

Despite the prevailing apprehensions regarding the cryptocurrency’s energy consumption, Bitcoin has yielded substantial returns for its investors and may also be deemed a commendable ESG (Environmental, Social, and Governance) investment.

If you possess a conventional finance background, you would be well-versed in the concept of ESG investment. The term ESG, an acronym for environmental, social, and governance, pertains to a set of criteria employed by conscientious investors to evaluate potential investments. Typically, investors interested in ESGs prioritise financial gains and endeavour to ensure that their investments positively contribute to the world.

After considering all of these factors, it seems reasonable to propose that Bitcoin (BTC) has the potential to be one of the most remarkable ESG (Environmental, Social, and Governance) investments of all time. Importantly, the digital currency has not only provided significant gains for its investors (currently, BTC has appreciated by seventy-one per cent (71%) in 2023, three hundred forty-two per cent (342%) over the previous three years, and an incredible forty-four thousand four hundred four per cent (44,404%) over the last decade), but it has also had a significant and positive impact on a global scale.

Higher bitcoin volume, lesser fossil fuels

If we were to increase our Bitcoin investment while simultaneously decreasing our reliance on fossil fuels, it could lead to a more sustainable and eco-friendly future.

Bitcoin seems to be among the limited industries, both nationally and internationally, that do not depend primarily on coal for its energy supply. According to a recent study, a significant proportion of BTC mining heavily relies on off-grid energy sources, with 52.2% of the Bitcoin network being powered by zero-emission energy.

At least 29 mining enterprises utilise 90%-100% zero-emission energy, and another 12 use emission-negative sources.

When compared to the primary electrical grid in the U.S., which derives only 36.7% of its energy from zero-emission sources, it becomes evident that almost every significant industry in the U.S. depends on a grid that is predominantly powered by fossil fuels. In contrast, Bitcoin mining operations are predominantly powered by zero-emission sources, making it an outlier in this regard.

Additionally, Bitcoin’s consistent demand for electricity stabilises the electrical grid by utilising any surplus energy produced, thereby enhancing the operational efficiency of power plants and reducing energy costs for consumers.

Source: https://batcoinz.com/bitcoin-by-energy-source/

A Shoot up on Energy efficiency

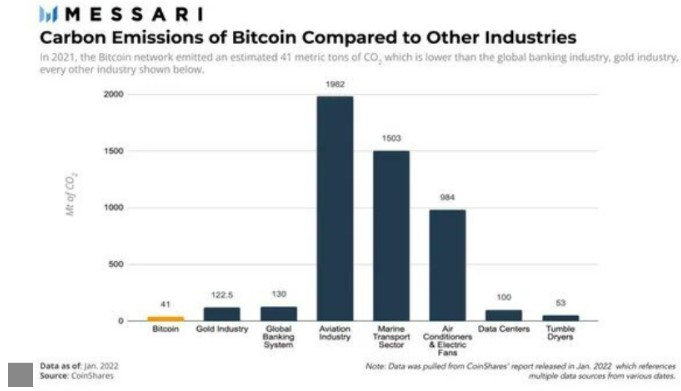

Besides its predominant reliance on clean energy sources, the Bitcoin network is also notably more energy-efficient than traditional financial systems. Bitcoin mining accounts for less than 0.2% of global energy consumption and only 0.09% of the world’s CO2 emissions. Compared to gold mining, which is often compared to Bitcoin as a store of value, Bitcoin mining consumes less energy and does not produce heavy metal pollutants. Thus, adopting a Bitcoin standard as a replacement for the legacy financial system or gold could have a significantly positive impact on the environment.

Furthermore, the consistent demand for electricity by Bitcoin mining operations also has the potential to stabilise the electrical grid by absorbing any excess energy generated. As a result, the operational efficiency of power plants can be enhanced, leading to reduced energy prices for consumers.

Source: https://twitter.com/MessariCrypto/status/1500492844758351875

A Boost on Innovation

By incentivising technological innovation, Bitcoin encourages the development of new clean energy solutions that could have broader applications beyond just the cryptocurrency industry. As more companies compete to offer the most energy-efficient mining operations, it could lead to significant advancements in clean energy technology, ultimately benefiting the environment and society as a whole.

The most significant environmental impact of Bitcoin could be its role in promoting the adoption and innovation of clean energy sources. The adverse effects of methane gas on the environment are 25 times worse than those of carbon dioxide (CO2). According to the Climate and Clean Air Coalition, reducing methane emissions is considered the most effective strategy to slow climate change over the next 25 years.

Interestingly, two of the largest methane producers are oil fields and landfills, and Bitcoin mining can contribute to mitigating these sources of pollution.

Vespene, a Bitcoin mining company, has introduced an innovative method of utilising the methane produced from landfills to power their mining rigs. This approach ensures that methane emissions are eliminated, thereby promoting environmental sustainability. Notably, Bitcoin mining with methane-vented power has proven to be more efficient in mitigating carbon emissions than any other renewable energy source currently available. The process of mining Bitcoin from vented methane has been found to remove 13 times more emissions from the environment than what coal puts into it.

With the increasing adoption of clean energy sources and the utilisation of innovative methods such as converting landfill methane into electricity, it is possible that the carbon emissions prevented by Bitcoin mining may eventually exceed the emissions produced by the electricity used to power the network. This could have a significant positive impact on the environment and further cement bitcoin’s position as a potentially great ESG investment. However, continued efforts and innovation in this area are necessary to achieve this goal.