Why do even experienced international companies face risks and fines despite automation and external support? How will the VAT system for businesses in Europe change and how can they prepare for the new 2025 requirements?

I’ll explain how the COREDO team addresses these issues and why a sound approach to VAT for startups in the EU, B2B/B2C and e-commerce is the key to sustainable development in the European market.

Read to the end — you’ll get not only practical recommendations but also a strategic view of the future of VAT for international companies.

VAT registration and threshold in the EU 2025

VAT registration and threshold in the EU 2025 is an important aspect of operations for any business conducting activities in the European market. In 2025 EU countries updated the requirements and threshold values for mandatory VAT registration, which significantly affects the launch and development of entrepreneurial projects in different jurisdictions. Below we will examine in detail the current VAT registration thresholds by country and the latest changes that should be considered when planning business in Europe.

VAT registration thresholds by country

In 2025 new minimum thresholds for the VAT registration threshold 2025 come into effect for most EU countries. This significantly affects the strategy for entering the European market, especially for non-residents and companies operating under distance selling models.

| Country | VAT registration threshold 2025 | Features/Comments |

|---|---|---|

| Germany | €22,000 | Residents only |

| France | €85,000 (goods) / €37,500 (services) | Split by type of activity |

| Greece | No threshold | Mandatory registration |

| Czech Republic | CZK 2,000,000 (~€80,000) | Residents only |

| Estonia | €40,000 | For all companies |

| Cyprus | €15,600 | For all companies |

| United Kingdom (for non-residents) | £0 | Mandatory registration when making supplies into the country |

VAT registration for non-residents – requirements

For companies without a legal presence in the EU, the VAT registration procedure becomes more complex. In some countries (for example, France, Germany, Italy) appointment of a VAT fiscal representative is required: a local tax agent responsible for interacting with tax authorities and timely fulfillment of VAT obligations for the companies.

Key VAT registration triggers for non-residents include:

- Storing goods in EU warehouses (Fulfillment by Amazon, 3PL)

- Providing digital services B2C

- Distance selling exceeding the €10,000 threshold (OSS/IOSS)

- Participation in marketplace oversight (when the platform becomes the tax agent)

OSS or IOSS, which to choose for reporting?

Since 2021 the OSS (One Stop Shop) and IOSS (Import One Stop Shop) systems have been in effect for distance selling and digital services. This allows using a single VAT registration for all EU countries and filing unified reporting. Still, the choice of scheme depends on the business structure, type of goods/services and the country of storage.

VAT: new requirements and risks

In 2025 control over VAT for e-commerce and digital services is being tightened, and the list of mandatory data for reporting and storage is expanding.

VAT for SaaS and digital services

From 2025 the definition of digital services and virtual goods becomes broader: regulation covers not only classic SaaS but also AI-driven tools, NFTs, and digital subscriptions. Implementation of ViDA requires companies to automate the calculation of VAT rates by place of consumption (place of supply), as well as integration with national registers for client verification.

VAT for marketplace sellers and distance selling

From 2025 responsibility for VAT payment for marketplace sellers partially falls on platforms (marketplace oversight), but this does not relieve sellers of the need to maintain records,

store documents and monitor compliance with the distance selling threshold. For sellers using warehouses in several countries, it is important to track movements of goods and register in new jurisdictions in a timely manner.

VAT for B2B and B2C: features and risks

For B2B transactions in the EU, the reverse charge mechanism applies: the tax liability is shifted to the buyer, but only with correct documentation and verification of the customer’s status. Errors in determining the place of supply or late registration lead to risks of additional assessments and VAT audit.

For companies providing services with installation/assembly (installation/assembly supplies), it is important to consider the new 2025 rules: the place of taxation is determined by the place where the work is performed, not by the supplier’s registration.

ViDA and automation of VAT reporting

OSS and ViDA scheme, step-by-step guide

- Determination of the scope of operations: all supplies of goods and services between EU countries are analyzed.

- Choosing the OSS/IOSS scheme: registration in one EU country, submission of a single declaration for all countries.

- Integration with ViDA: automation of real-time data transmission, storage of digital documents.

- Control of VAT rates and place of supply: automated calculation of rates and determination of the country of taxation.

- Filing reports: monthly or quarterly, depending on turnover and business type.

Document requirements for VAT in 2025

Violation of these rules is a direct path to VAT penalties and a tax audit.

Tools for automating VAT compliance

Modern solutions for VAT automation include:

- AI-driven tools for calculating VAT rates and controlling VAT obligations for companies in different EU countries

- Integration with marketplace and e-commerce platforms

- Modules for automatic generation and storage of VAT reporting

- Systems for monitoring VAT registration triggers and distance selling

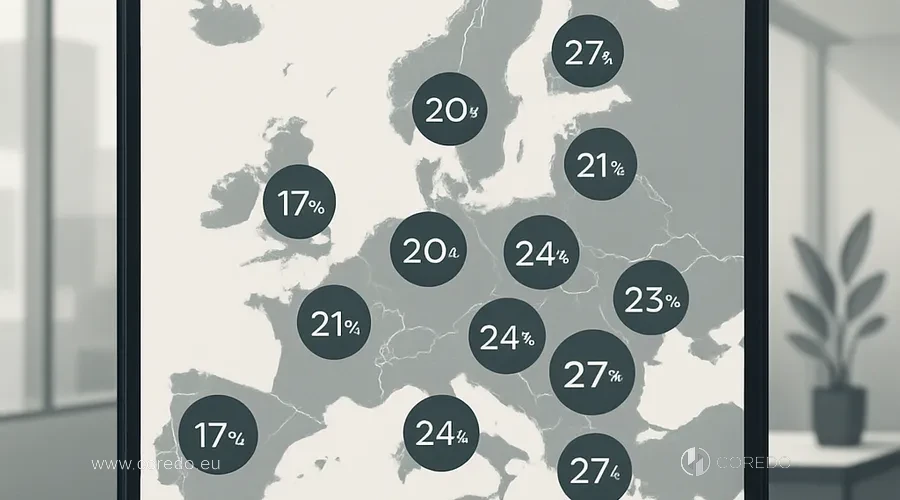

VAT rates in EU countries

Differences in VAT rates across EU countries create additional challenges for international companies, especially when supplying goods and services to multiple jurisdictions.

VAT rates in EU countries – comparison table

| Country | Standard VAT rate | Reduced VAT rate | Notes |

|---|---|---|---|

| Germany | 19% | 7% | Food, books |

| France | 20% | 5.5% / 10% | Food, transport |

| Czech Republic | 21% | 15% / 10% | Medicines, books |

| Estonia | 20% | 9% | Medical services |

| Cyprus | 19% | 5% / 9% | Tourism, transport |

| Slovakia | 20% | 10% | Food, medicines |

Choosing a country for VAT registration in the EU

The choice of jurisdiction depends on:

- Location of the warehouse (VAT for storing goods in warehouses in the EU)

- Countries where the main customers are concentrated

- Requirements for appointing a fiscal representative for non-residents

- Peculiarities of taxation of certain sectors (for example, VAT for supplies of electricity, gas, heating and cooling)

EU VAT and changes from 2025

The year 2025 will be a turning point for EU VAT: digitalization of reporting, expanded regulation of new sectors and tighter control over international companies.

ViDA: VAT changes for business

The VAT reporting scheme ViDA introduces:

- Mandatory electronic reporting for all companies operating in the EU

- An expanded definition of digital services and virtual goods

- New requirements for client identification and data retention

- Integration with marketplace oversight and automatic data exchange between tax authorities

New requirements for marketplace sellers and SaaS

Marketplace sellers are required to integrate their systems with tax authorities data sharing platforms, monitor VAT compliance for SaaS and AI-driven services, and ensure transparency of supply chains (supply chain compliance) for B2B and B2C.

StrategicRisks in the technology business

For technology companies and startups in the EU, the key risks remain:

- Increase in administrative burden (administrative burden)

- Tightening of VAT audit and control over VAT obligations for companies

- The need for constant monitoring of changes in VAT harmonization and national legislation

At the same time, a sound VAT compliance strategy opens up new opportunities for international expansion and optimization of the tax burden.

Key recommendations for businesses

Key recommendations for businesses help prepare in advance for changes in tax regulation and minimize risks for the company in 2025. With the update of VAT rules, registration and compliance become an integral part of stable operations and long-term business growth.

VAT registration and compliance in 2025

- Conduct an audit of the business model and determine the VAT registration threshold 2025 for all countries of presence.

- Choose the optimal OSS or IOSS scheme for distance selling and digital services.

- Appoint a VAT fiscal representative where required for non-residents.

- Implement automated systems for monitoring VAT obligations and VAT reporting.

Errors and risks when working with VAT

- Regularly update knowledge on national and pan-European changes in VAT for business in Europe.

- Use automation to control filing deadlines and store VAT documents.

- Conduct an internal VAT audit at least once a year.

- Implement best practices for supply chain compliance for international supply chains.

Metrics for assessing VAT compliance

- VAT reporting processing time (before and after automation)

- Number of errors/corrections in VAT returns

- ROI from implementing AI-driven tools for VAT automation

- Level of administrative burden on the team

EU VAT: changes in 2025

What are the main changes in the VAT registration threshold 2025?

The future of VAT in the EU: what businesses should consider

In 2025, EU VAT becomes not just a tax obligation but a strategic tool for international business. Comprehensive support, process automation and a deep understanding of the new ViDA standards make it possible not only to minimize compliance risk but also to create competitive advantages for companies focused on international development.