Financial Conduct Authority (FCA) published an article on their website last July of 2020 revealing that the surveys they conducted suggested that several institutions, which includes the United Kingdom (UK) Electronic Money Institutions, also known as EMIs, were combining clients and the company’s funds in order to keep transactional records inaccurately. It was also found that some do not have an effective and sufficient process for managing their business risks, which, in turn, makes them fail in protecting their accounts based on the standards set by the FCA. More information about the survey can be found on FCA’s website.

Further, in 2019, one more survey was done among eleven non-bank payment platforms and it concluded that there are some financial institutions that cannot explain what payment service they offered in particular scenarios, or even point out when they were releasing electronic money. It is also unclear as to when they are serving as the payment distributor on behalf of another payment service provider. This just means that these institutions do not have accurate identifiers and records of the funds and are not practicing the required standard in protecting the right amount of the said funds.

As bad as it may sound, the surveys were not only applicable to the United Kingdom, but also to some more nations in Europe. Specifically, it is noteworthy that Lithuania is among these, even being one of the main financial technology hubs.

Now, let us check what efforts these financial companies exert with regard to the licensing of electronic money (e-money) in European countries to safeguard the rules and regulations and to properly utilize the accounts.

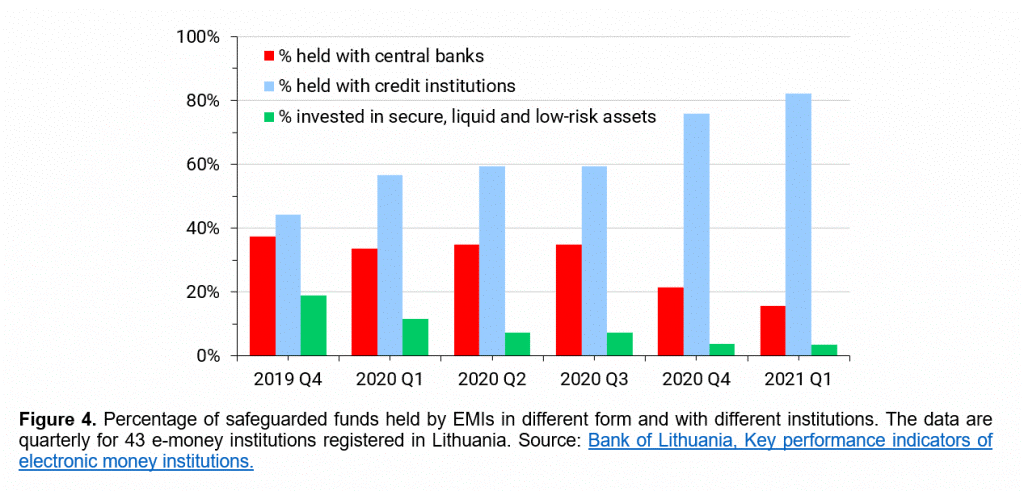

To be able to determine this, a statistical analysis of the data from the database of the Bank of Lithuania, containing forty-three (43) Electronic Money Institutions in the same country from 2019 – 2021, was conducted.

As a result, forty-eight per cent (48%) of the sample of Lithuanian financial companies with e-money licenses incurred a discrepancy of more than fifty per cent (50%). Meaning, there are inequalities in the safeguarded accounts these companies hold versus the e-money they possess in hand. We may call these scenarios as “shortages”, which, by definition, is having less safeguarded money in relation to e-money. In the same way, it may also be a case of “excesses”, which means that there are more safeguarded funds in relation to e-money. To note, excesses are more common than shortages.

The conclusion having that big percentage of results, loudly suggests that practicing to safeguard the accounts is necessary for Electronic Money Institutions. This holds true considering that there are new participants in the EMI industry. In accordance with the data from the same study, sixty-two per cent (62%) of financial institutions having Small Electronic Money Institutions (EMI) Licenses also has more than fifty per cent (50%) discrepancy.

To further understand this, let us elaborate on the balance sheet contents of safeguarding the accounts of clients. Next would be the statistical analyses of these data.

Explaining account safeguarding and segregation through balance sheets

An essential part, but possibly infamous variance on credit institutions (wherein high-street and money-centre commercial banks are included) versus electronic money institutions (EMIs) is that EMIs must create a process that will totally secure the funds of their customers and maintain separate accounts from their own “segregated accounts”. However, credit institutions have the freedom to mix these funds deposited by their clients together with the companies’ funds and use these accordingly through investments or to extend the credit.

With this, even though EMIs have full access to their customers’ accounts or funds, they cannot use these for their own business intention aside from just transacting through issuance and e-money redemptions.

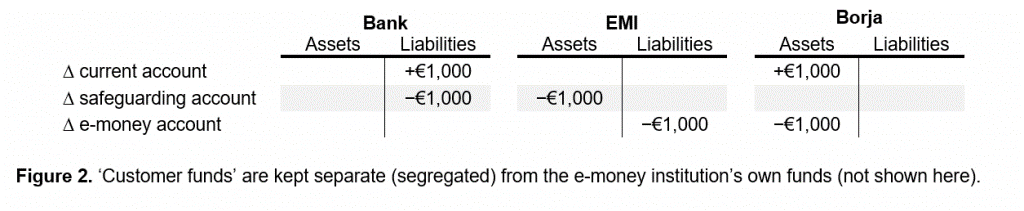

In the same way, EMIs are sticking into this condition. Let us give an example. A customer wants to transfer funds from his current bank account to another person’s bank through e-money, using EMI. Say for example the amount wanted to be transferred is one thousand euros (EUR 1,000). The two financial institutions will, then, perform the following on the back end to be able to complete the requested transaction.

- If in case the EMI is the holder of the customer’s fund with the same banking institution that holds the current account, the bank will debit the account and credits it to the EMI’s account. This is called “in-house settlement”, which means that there is no money leaving the bank (as what is shown in Figure 1).

- Having the same concept, if a customer wants to transfer money from his e-money account, the opposite of the process will be performed. In this case, for each euro (EUR 1.00) leaving the e-money account, an outflow of EUR 1.00 will be reflected on the customer’s safeguarded EMI account (considering that the funds will not be transferred to another client of the same EMI, as shown in Figure 2).

The ins and outs of the transactions elaborated on figures 1 and 2 are leading us to an expectation that once all those transactions are made into the electronic wallets of the customers through EMIs, each transaction on the EMI will have the same amount of funds in its clients’ asset, as a balance of the electronic money in its liability. That is to say, a “parity” is expected between the mentioned components, and will lead into the EMI’s balance sheet as the following:

However, what happens in real life is quite more cluttered. The rules and regulations we have for Electronic Money Institutions are not that strict. On the abovementioned figure (Figure 3), let us take the assumption that EMI is holding the fund through one more credit firm. Nevertheless, these EMIs may also consider the central bank, or in some cases, use the funds to invest in a more liquid asset that has lower risk factors.

In Figure 4 below, forty-three (43) EMIs from Lithuania are analyzed. In the analysis, three methodologies (that is, central bank, credit institutions, and more secure, low-risk and liquid assets) in holding an account were used unvaryingly during 2019. In quarter one (Q1) of 2021, most of the accounts were transferred to credit institutions.

Adding up to that, it is highly probable that Electronic Money Institutions may keep safeguarded accounts in currencies where their denomination is different from that of the respective electronic money liabilities’. Take this scenario as an example: There is a customer wanting to invest in euro (EUR) electronic money fund, and at the same time, the same amount of funds (considering its corresponding foreign exchange rate) placed on the particular EMI are in United States dollar (USD) safeguarded account.

Furtherly, we must not overlook Article 25 of the Law on Electronic Money and Electronic Money Institutions stating that EMIs have two choices as to how they could provide proper safeguarding of their client’s accounts.

These two are:

- The Segregated funds method – this is what is shown in the aforementioned outline.

- The Insurance policy method.

On the analysis of the Bank of Lithuania in 2019, the first method is the one mostly used by EMIs, therefore, resulting in the segregated funds method being set aside in this specific review.

Having these, and some more operational factors, reoccurrence of discrepancies may persist. This can be described as: scenarios wherein the amount of assets the EMIs are keeping on their safeguarded account is different from that of the electronic money amount of liabilities they have on issuance.

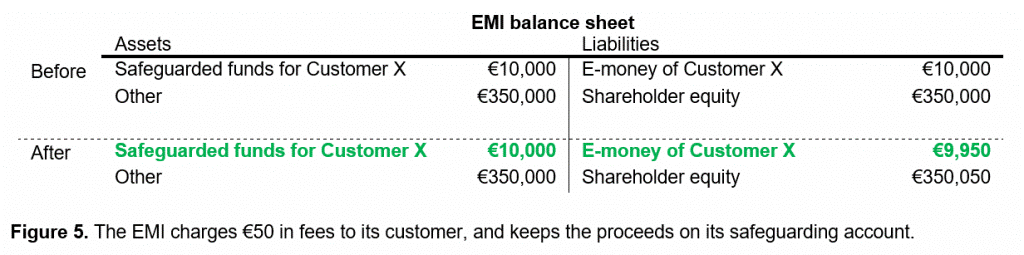

On the balance shown in Figure five (5) below, a case where discrepancy may occur is visible. On this balance sheet, before and after the fee for Customer X from EMI costs fifty euros (EUR 50). Customer X is debited with e-money for an amount of EUR 50, and then holds the earnings in the account which is safeguarded. This resulted in the account having a discrepancy amounting to EUR 50.

The authorities, during the period when they know that the process of totally eradicating the discrepancies will bring forth operational burden and may not be worthy of all the effort it will take, still require the EMIs to conduct settlements as oftentimes as possible. A sample case would be when the Financial Conduct Authority (FCA) spelt out (in 2021) that if ever there are discrepancies caused by reconciliations, the EMIs are required to provide justification regarding those discrepancies, and rectify them the soonest possible through payment of any deficit, and withdrawal of any extra amount, not unless the recorded discrepancy is from timing difference of the reporting system within the accounting department. Further, it was emphasized that the rectifications must be made within the specified business day.

Additionally, FCA provided two factors with regard to conciliating the assets’ safeguarding. Those are:

- It must be enough to make up for the expenses the company will need for the process of safeguarding before the next round of reconciliation.

- It should not be exaggerated so as to prevent the negative effect of commingling.

When it comes to considering the law of the western countries, specifically in Europe, there is no specific rule mirroring the mentioned ones from FCA. Instead, what they have in regulation is Article 7(1) of Directive 2009/100/EC. This establishes the qualifications and requirements for safeguarding clients’ accounts and is comparable to that Lithuania’s – Article 25 of the Republic of Lithuania Law on Electronic Money and Electronic Money Institutions.

To explain it more, the reasoning behind the existence of reconciliation because of the proper recording of the accounts. What is more, is that the consequential effect of mixing customers’ assets together with the companies’ funds and the succeeding liquidation of the companies’ funds may probably result in the customers’ funds being on the insolvency estate as well. However, truth be told, it will also eradicate the advantages of having a safeguarded account.

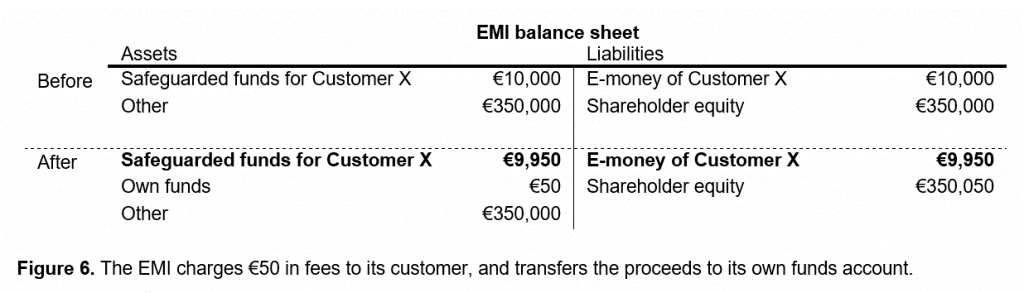

Continuing using the example from Figure 5, the way to correct the recorded discrepancy is when EMI transfer EUR 50 from their account that is safeguarded to its own account within the end of the same business day. This is ideal to restore the difference between the electronic money versus the safeguarded account and by doing that, the balance sheet will reflect as what is on Figure 6 below:

With all these, how can one tell that EMIs are sticking to the real-life qualifications and requirements of safeguarding accounts? The next part of this article will tell us through empirical data.

When the Data Talks

The simplest and most accurate technique to check if there are variances in the customers’ safeguarded account versus what is kept on the electronic money in issuance is through analyzing and comparing the balance sheets of the two accounts.

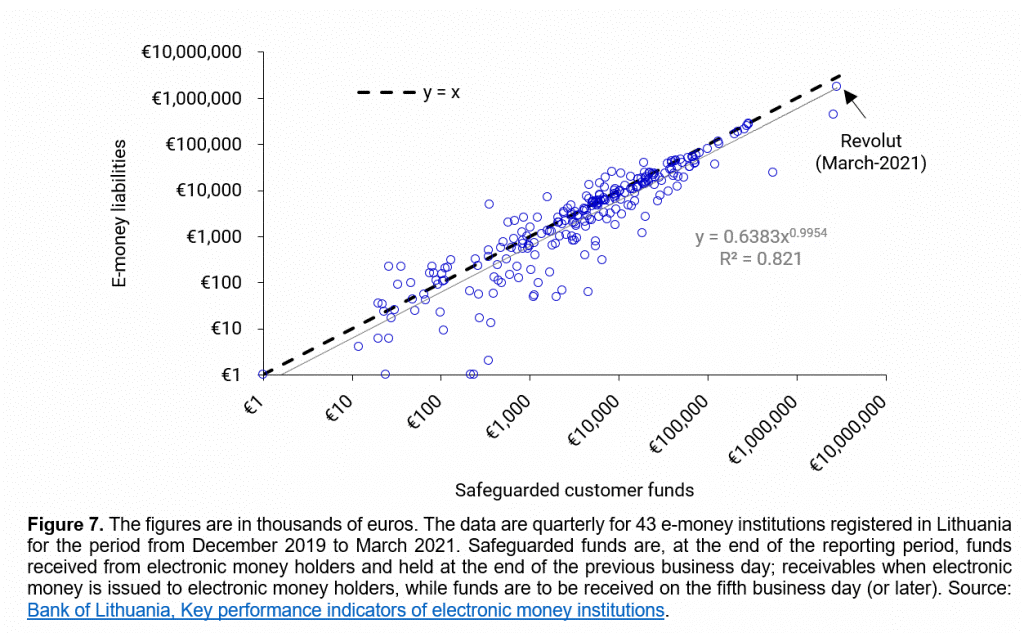

In this part, the analysis came from the data of forty-three EMIs from Lithuania. Figure 7 below is a scatterplot of the funds in both segregated (horizontal / x-axis), and the total outstanding electronic money liabilities (vertical / y-axis). From this, the two funds are visibly the same and significantly co-related, but not necessarily identical.

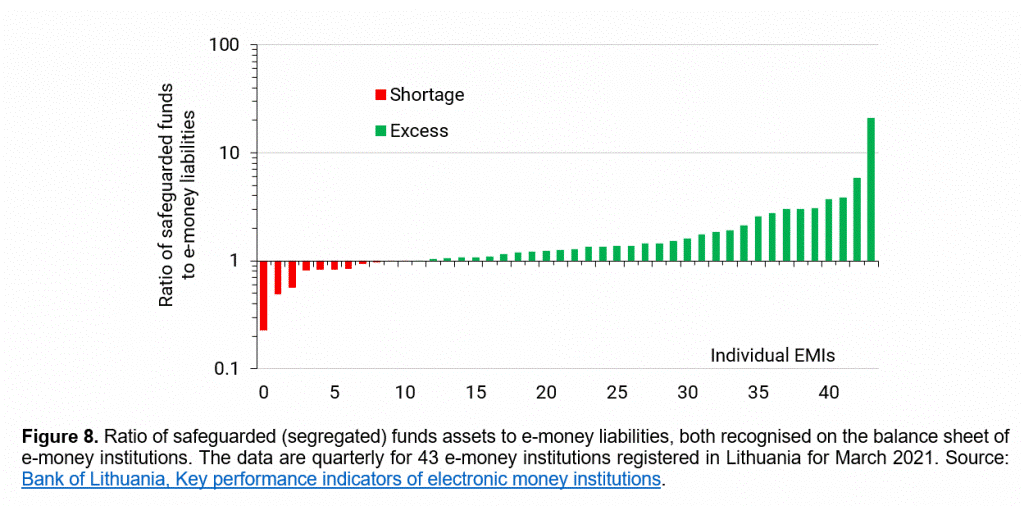

In Figure 8, a close-up of the variances is even more visible by looking at their respective ratios for the month of March 2021. With this, imbalances are indeed normal, and significant in volume, even though it is more on the “excess” part of the graph. This is considering that the ratio’s median of segregated accounts to electronic money liabilities is 1.26 during the period of December 2019 up until March 2021.

Now, take note that whether a discrepancy is an excess or a shortage, both are unpleasant from the point of view of authorities. As such, calculating the imbalances will show more than fifty per cent (50%) discrepancy, which means that they kept safeguarded money is either greater than less than 50% from that of the e-money they currently have.

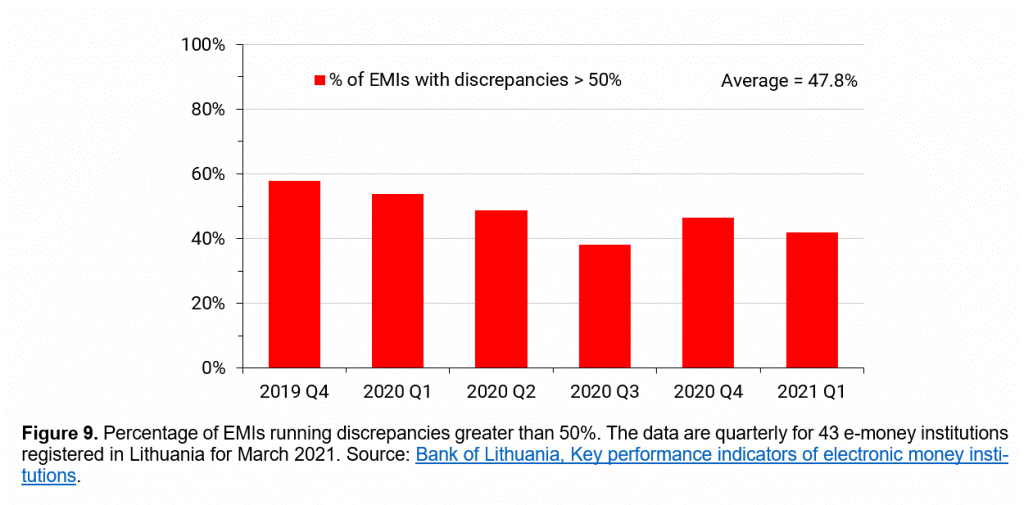

The data are remarkable: forty-seven point eight per cent (47.8%) of the EMIs have variances of greater than fifty per cent (50%) by average. This is clearly shown in Figure 9.

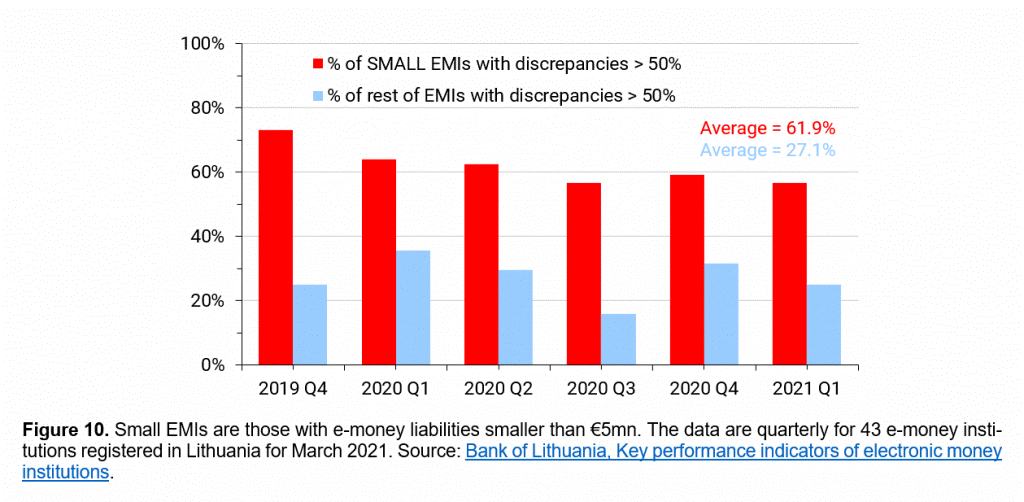

For further analysis, we can separate the data into two subgroups: small EMIs (that is, data with electronic money of less than EUR 5 million), and the remaining would be those greater than or equal to EUR 5 million. By doing so, it was concluded that small EMIs are the top lawbreakers having sixty-one point nine per cent (61.9%) recorded discrepancy from the benchmark of 50%. Bigger EMIs have a lower discrepancy percentage, having twenty-seven point one per cent (27.1%) as what is reflected on Figure 10.

These results are distressing. If we take into account that the analysis done hypothetically suggests that fifty per cent (50%) of the credit companies in Europe have a Liquidity Coverage Ratio (LCR) of less than one hundred per cent (<100%), and twenty-seven per cent (27%) of the Global Systemically Important Banks (G-SIBs) have Leverage Ratio (LEV) of less than three per cent (<3%), neither have passed the standard set by the Basel III authorities.

Nevertheless, Republic of Lithuania Law on Electronic Money and Electronic Money Institutions is different from the United Kingdom’s Financial Conduct Authority (FCA). The former does not have a limit when it comes to working days in terms of correcting the variances in EMIs. Therefore, small EMIs are seen to have been performing poorly in providing safeguarded accounts.

Indeed, United Kingdom-based Electronic Money Institutions are not an exception to the discussion, and it seems like there are also inefficient and ineffective processes in safeguarding their customers’ funds as a whole.

How can COREDO help you?

If you are in need of professional advice as an existing EMI client or a new individual in the field, we have the appropriate consultants for you who can. You may view the services that we can offer through this link: https://coredo.eu.