COREDO – EU Legal & Compliance Services Expert legal consulting, financial licensing (EMI, PSP, CASP under MiCA), and AML/CFT compliance across the European Union. Headquartered in Prague, we provide seamless regulatory solutions in Germany, Poland, Lithuania, and all 27 EU member states.

Is the inadequacy or unavailability of any plausible progress in achieving a fundamental agreement with the European Union before the conclusion of the transitional phase on December 31st, 2020, the primary challenge in the United Kingdom’s financial industry? Without a second thought, ever since Brexit, the pandemic caused by CoronaVirus has hindered the development and expansion of Financial technology in London, United Kingdom.

Out of all the European nations, London, which has long been a favourite for the formation of potential Financial technology unicorns, has continued to suffer the most.

Research and studies were conducted on recently authorised and operational payment systems and electronic money institutions (or EMI), small Application Programming Interfaces (or APIs), small EMIs, and Account information services (AIS). Payment initiation services (PIS) authorised institutions in the European Union (EU) from August 2017 up until August 2020 to learn more about what is currently taking shape in the industry.

A EUCLID database, or European Centralised Infrastructure for Supervisory Data, was used for the research. In the mentioned database, the strategy is for the platform to interpret data developed and utilised by the European Banking Authority (EBA) to collect and analyse various financial companies’ regulatory sets of information. It was therefore concluded that in 2017-2018 there were one thousand two hundred twenty-two (1,022 ) ultimately authorised enterprises; in 2018-2019, there were one thousand one hundred and eight (1,108) freshly certified corporations; and in 2019-2020, the number plummeted to five hundred and seventy-eight (578), a shocking forty-three percentage (43 %) decline for licenses and permits of financial technology in the European Union.

Summary of the data on the evaluation and approval of FinTech institutions in the United Kingdom and the European Union both before and after Brexit

Number of newly authorised/registered and operational PSPs in Europe

The pandemic brought by CoronaVirus caused a sharp decline in the Gross domestic product (GDP) across Europe, and the pressure on the payment systems industry with a number of emerging payment and electronic money institutions duly authorised historically in 2017 to 2019 were the leading causes of such a significant decrease in new authorisations in 2019 until 2020.

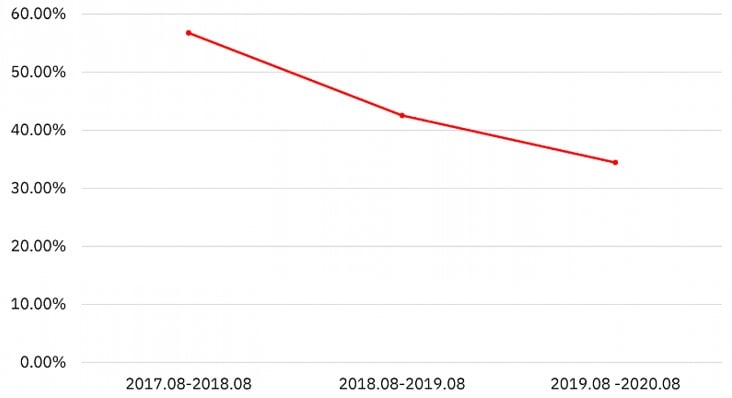

These figures on FinTech authorisations in Europe clearly show that the United Kingdom is the biggest loser. From 2019 to 2020, there were approximately fifty-four percent (54 %) fewer new authorisations in the United Kingdom than there were in the rest of the EU. It was observed that the UK’s share of new authorisations within the EU decreased from fifty-six (56 %) in 2017 to 2018 to thirty-four percent (34 %) in 2019-2020, when we started to look at the percentage of new payments and electronic money institutions legally authorised in 2018 to 2020. There is no absolute doubt that this was not due to CoronaVirus.

United Kingdom’s share of freshly authorised and active EU PSPs

Only after the UK represented approximately half, or about fifty percent (50%) of all payment and electronic money (and several other forms of PSP) institutions licensed in the country, however as of August 2020, the United Kingdom’s share is just 31.59% out of 3,843 authorised PSPs. There has been a definite trajectory of a decrease in the UK proportion of incoming licenses and permits of Financial technology institutions throughout Europe. In three years, London’s contribution has plummeted by a staggering thirty-nine percent (39 %).

Time to discuss Brexit and London FinTech

With the unsatisfactory UK-EU trading negotiations findings, something off cliff Brexit is becoming increasingly likely with each passing day, and apart from the inevitable loss of foreign passporting rights, there are other essential aspects to consider:

- There are nevertheless serious worries that UK financial intermediaries, payment organisations, and electronic money institutions could very well end up losing their involvement in SEPA clearing of SCT, SCT Instant, and SDD even though European Payment Counsel informed its UK participants in the spring of 2019 that they could continue participating in SEPA regardless of what happens of the Brexit agreement on trade-related negotiations.

- The popular Temporary Permission Regime, which allows European businesses to register and request short-term permission to conduct business in the United Kingdom, will re-open on September 30th, 2020, according to Financial Conduct Authority (FCA). It is still unknown whether the European Union or specific EU member states will implement a similar temporary permission regime for London Financial institutions following Brexit. As of the date of this posting, a few participating countries (such as Poland, Germany, Sweden, France, and Italy) have each passed legislation at the government level that permits access to the common market of specific financial offerings (predominantly wholesale, like making trades in derivatives), though in the occasion of an unfavourable Brexit.

- United Kingdom’s opinion on the matter after the transitional deal sides makes one wonder. Data security is one of the significant risks, and the Court of Justice of the European countries recently ruled that the United States’ data security standards are not comparable to those of Europe. This decision prohibited information exchange from Europe to America based on the EU-US Privacy Shield. It will actually impact, for example, a European Union firm delivering services in the country beneath the Temporary Permission Regime, given that it will be controlled all at the same by the native country supervisory authority and the FCA. Numerous financial technology enterprises depend on United States IT giants supplying information technology services. In this scenario, which data security framework (EU, UK, or both) should apply to these corporations’ UK consumers’?

- Will the EBA’s current Strong Customer Authentication and other regulatory technical specifications remain applicable to European businesses operating in the United Kingdom under the Temporary Permission Regime and UK-authorized companies?

- Regarding the bilateral agreement, the EU attempts to prevent any accord requiring confirmation by the legislative bodies of participating countries. A comprehensive joint venture transaction could be controlled, guaranteeing that certification will be necessary just by the European Parliament and United Kingdom Government. The conclusion of October 2020 is anticipated to be the most likely target date for reaching this consensus. Unless this is accomplished, it is highly improbable that it will be signed into law in time for December 31st, 2020. Nonetheless, in any instance, quite an arrangement would not immediately enable single market access for enterprises that are delivering customer-centric financial services. A whole other alternative choice for the finance industry may be the commission’s particular circumstance mechanism under the known “equivalence regime” (which makes it look at the purpose and impact of the laws and regulation of non-participating states instead of literal imitating) having allowed for the stipulation of some of these offerings to the EU from non-EU countries and vice – versa. Nevertheless, for the similarity to be valid, such a provision must be included in the European legislation governing the specific category of offerings. In this respect, the UK will try to convince the EU Parliament to change just several guidelines for them to allow for the use of equivalence as a basis for argument. Even this final option has limitations because the equivalence determination may be revoked at any time and because, like the trading relationship, it is likely to be unsuccessful for retail financial institutions.

Effects on the FinTech industry in the EU and the UK

It is apparent that significant financial technology enterprises both in the United Kingdom and European Union have already secured additional authorisations, whether in the EU or UK correspondingly. Unfortunately, most medium-sized and small-sized payment and electronic money institutions across the UK and EU countries have still not attained the off-the-cliff Brexit.

The timetable of the trade deal negotiations sounded ambitious back in the year 2017, and able to look back now from Covid – 19 toughest-hit European countries; it seems most unrealistic today. The sectors of the economy of the UK and the EU are so intertwined and dependent on one another that it seems impossible to dismantle what has been built over nearly fifty (50) years in an orderly fashion.

The timetable of the trade deal negotiations sounded ambitious back in the year 2017, and able to look back now from Covid – 19 toughest-hit European countries; it seems most unrealistic today. The sectors of the economy of the UK and the EU are so intertwined and dependent on one another that it seems impossible to dismantle what has been built over nearly fifty (50) years in an orderly fashion.

Payment and electronic money institutions in the UK and the EU should obtain the necessary rulings and regulatory authorisations in either the EU or the UK as an endorsement of the transitional phase beyond December 31st 2020, is highly improbable. This will help these institutions avoid political uncertainty and regulatory restrictions and maintain compliance throughout these challenging times for the industry.

You can schedule a free initial consultation with COREDO experts to get guidance on regulatory licenses and permits in either the EU or UK if you are a FinTech company beginning to wonder how to remain in business in either the EU or the UK (London) after Brexit while remaining compliant with the regulatory requirements.