I welcome you as the CEO and founder of COREDO. Since 2016 our team has been helping entrepreneurs from Europe, Asia and the CIS overcome the barriers of international expansion. We focus on company formation, obtaining financial licenses and ensuring AML compliance, turning complex regulatory challenges into competitive advantages. In this article I will share a practical guide based on real experience: how to balance substance requirements with licensing, minimize risks and achieve tax benefits of 0-3% with real economic presence. Over the past 10 years we at COREDO have supported more than 280 international structures – from IP holdings and payments startups to licensed financial companies. We have been involved in projects with CySEC, Labuan FSA, FSC Mauritius, BVI FSC and ADGM, and have gone through regulatory interviews, substance audits and banking committees. All recommendations in the article are not theory but conclusions drawn from specific client cases.

Substance as the key to global markets in 2026

The COREDO team has repeatedly encountered this in practice: clients who ignored substance lost up to 6 months on re-registering structures.

It is precisely the CIGA logic that substance audits in the EU, BVI, Mauritius and Labuan are being structured around today.

COREDO’s practice confirms: for fintech startups in the EU CySEC requirements combine substance with KYC/EDD procedures, where the source of funds is checked at the start.

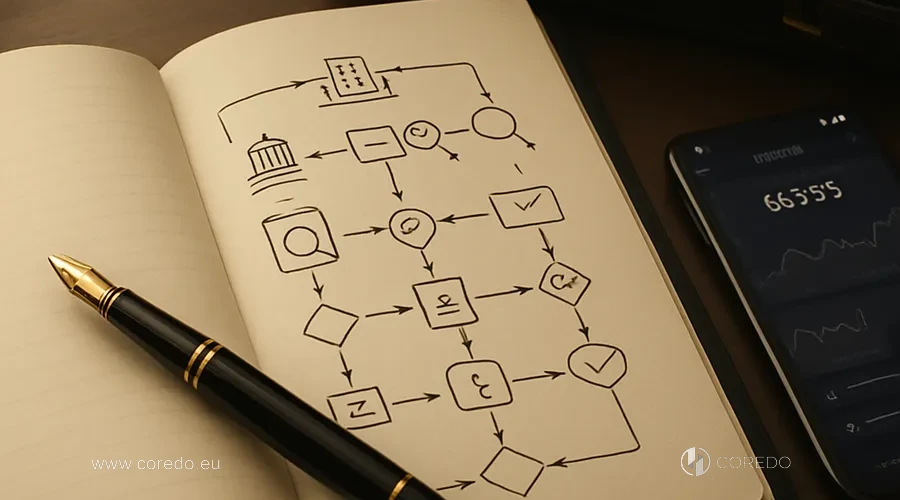

Steps to create economic substance: from analysis to compliance

Organize the process sequentially to save time. In our work we use a regulatory framework of four blocks: legal substance (structure and licenses), operational substance (personnel and processes), financial substance (expenses, capital, taxes) and compliance substance (AML, risk management, reporting). Without covering all four areas companies fail both tax audits and bank Due Diligence. Here is the algorithm we apply at COREDO for clients from Singapore and Dubai:

- Formalize the business model. Indicate the geography of clients, relevant activities and risks. For crypto service providers (VASP) in Anguilla, Anguilla substance 2026 requires a local compliance officer and EDD for high-risk sectors such as FX or adult.

- Choose a jurisdiction for your purposes. In the EU – Cyprus or Estonia for Crypto licenses EU and EMI/IBAN. In Asia: Labuan with Labuan FSA for trading companies: here Labuan substance audit focuses on digital reporting. BVI under the Economic Substance Act (ESA) is ideal for banking business: organize economic substance in the BVI with a local director. Mauritius with GBC structures balances substance and licenses for fintech: metrics such as real management and an annual audit by a trust company confirm tax incentives.

- Gather evidence of substance. Prepare a legal opinion on substance for the classification of activities. Implement internal controls: the fintech compliance officer monitors AML/CFT, UBO disclosure and the due diligence checklist. For Mauritius, GBC substance is measured by the number of directors’ meetings and on-site decisions.

- Simultaneously undergo KYC and bank due diligence. Banks require the articles of association, an extract from the register, a business plan and proof of sources of funding. The risks of lacking substance when opening an account are high: refusals increase by 40% in high-risk sectors.

Obtaining financial licenses for fintech and banks

As CEO of COREDO I personally participate in designing licensing projects, in negotiations with regulators and in preparation for supervisory reviews. We build models that are designed from the start to meet the requirements of regulators and banks’ risk committees, not for a formal «company registration».

Fintech Licensing: our strong suit. For a banking license or payment services in the EU go through the VASP frameworks with enhanced EDD. CySEC requirements for IT companies include a compliance officer and digital reporting to the FSC. In Asia Labuan FSA issues licenses for insurance and funds subject to a substance audit.

AML compliance and KYC: minimizing the risks of scaling

AML compliance: not bureaucracy, but business protection. Implement KYC procedures. In recent years we have assisted clients in dozens of enhanced due diligence procedures from banks and regulators. In practice we see: it is precisely a pre-established compliance framework that becomes the main factor why a company does not lose accounts, licenses and business partners when scaling.

Is it worth investing in a local team in the BVI for banking services? The ROI calculation is simple: savings on fines and taxes pay back the costs within a year.

Support: from registration to growth

registration from scratch vs a ready-made structure? Choose based on substance requirements: a shelf company speeds things up, but requires rapid adaptation. Our approach at COREDO is full-cycle: from jurisdiction selection to the annual audit. Clients from the United Kingdom and Estonia use us for IP holdings and holding companies, obtaining tax preferences when substance is demonstrated.

Ready to take the step? The COREDO team will ensure transparency, speed and support. Contact us; we’ll turn your idea into a global business.