In the world of cryptocurrencies and blockchain technologies, the classification of crypto assets plays a crucial role in defining their characteristics and legal status. The reflection of this classification in legislation is paramount for companies engaging in operations involving such assets. In this article, we will explore the widely accepted classification of crypto assets, their regulation at the European Union level, and the legal status of various crypto assets in the Czech Republic, with a particular emphasis on the role of the Czech VASP (Virtual Assets Service Provider) licence in this context.

What does Crypto Asset mean?

A crypto asset (token) is a digital representation of value or rights that can be transferred and stored electronically using distributed ledger technology (DLT) or similar technology.

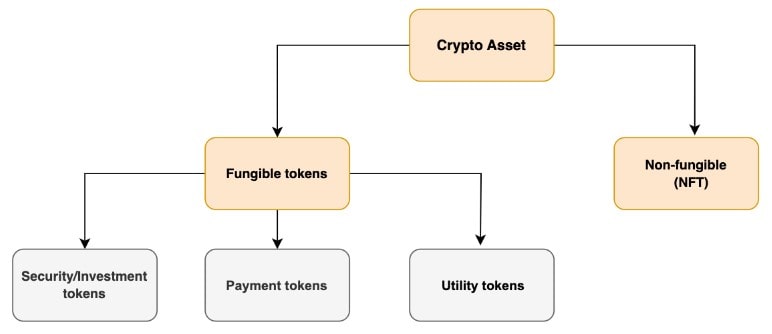

According to the commonly accepted classification of crypto assets, tokens are differentiated as follows:

Fungible Tokens are tokens that are not identical and can be exchanged with one another. Fungible tokens are typically classified as follows:

- Payment Tokens can serve as a means of exchange or payment;

- Utility Tokens may provide access to a specific product or service;

- Investment Tokens may represent financial claims against the issuer or grant governance rights to their holders (token-holders).

Non-Fungible Tokens (NFTs) tokens that cannot be interchangeable due to their uniqueness. Such a token is tied to specific information or an asset, such as a music track, video, or image.

How are Crypto Assets regulated at the European Union level?

The crypto-sphere is subject to regulation by the MiCA Regulation and MiFID II Directive. MiCA aims to establish uniform rules for crypto-assets in the European Union. In contrast, MiFID II focuses on financial instruments and the provision of investment services. MiCA’s provisions will come into effect from December 30, 2024. However, the final version of the Regulation has already been published and approved as of June 23, 2023. Moreover, specific token categories may also fall under the regulation of MiFID II.

The MiCA Regulation sets standards for identifying and classifying crypto-assets in the European Union. Based on the crypto-assets definition, MiCA differentiates individual tokens into three subcategories: utility tokens, asset-referenced tokens, and electronic money tokens.

- Utility Token (as per MiCA interpretation) is a digital token that provides access to goods or services through digital platforms. It lacks financial purposes and is associated with the token issuer. Unlike asset-referenced or electronic money tokens, a utility token is not tied to a specific asset. Its primary purpose is to facilitate the functional use of blockchain systems rather than creating future cash flows.

- Asset-Referenced Token is a type of crypto-asset aimed at maintaining price stability by being pegged to multiple fiat currencies, commodities, or other crypto-assets. It can be used for payments and savings. For the public offering or trading such tokens, the issuer must obtain a licence from the competent authority of its EU member state. It is important to note that, unlike utility token issuers, issuers of asset-referenced tokens must submit a “White Paper” for approval to the competent authority of their EU member state. The “White Paper” is considered approved upon the issuer obtaining a licence for the public offering or trading of such tokens on a crypto platform. This requirement is introduced to enhance consumer protection and market integrity.

- Electronic Money Token – a crypto-asset tied to a fiat currency and designed for stable payments. Unlike asset-referenced tokens, this token is primarily used for purchasing goods and services. The issuer of such a token must comply with a banking licence or electronic money provider licence requirements (depending on the situation) and publish its “White Paper.” Companies wishing to deal with this crypto-asset do not need a separate licence, as the issuance of this token is regulated by banking and electronic money laws. The issuer must also publish the “White Paper,” notifying the supervisory authority of its EU member state. However, similar to the utility token, the “White Paper” of an electronic money token does not necessarily require approval by the competent authorities of its EU member state.

However, despite the MiCA Regulation closing the existing regulatory gap regarding crypto-assets, it does not affect the regulation of crypto-assets already falling under the existing regulatory framework (e.g., MiFID II).

An interesting point

Notably, some non-fungible tokens (NFTs) remain outside the scope of MiCA Regulation. The Regulation explicitly states: “This Regulation should not apply to crypto-assets that are unique and not fungible with other crypto-assets, including digital art and collectables.”

Nevertheless, MiCA establishes that merely assigning a unique identifier to a token does not indicate its non-fungibility. According to the Regulation, tokens issued in large series may be deemed fungible, and, consequently, issuers and providers may need to obtain the necessary licence. At the same time, NFTs could hypothetically fall under the scope of MiFID II if the token exhibits characteristics of a financial instrument (e.g., representing a tokenized security or tokenized share).

Therefore, non-fungible tokens currently remain outside the realm of precise legal regulation at the EU level. In this regard, we strongly recommend issuers and providers to carefully examine the features and characteristics of each NFT they intend to work with to obtain the relevant licence if necessary and avoid penalties and criminal prosecution.

Considering the aspects reflected in the MiCA Regulation and MiFID Directive, the differentiation of crypto-assets can be illustrated as follows:

And what is the situation with the status of a crypto asset in the Czech Republic?

The status of crypto-assets in the Czech Republic involves a combination of European and Czech legal frameworks, each contributing its definitions and regulations for dealing with crypto-assets. Here are some clarifications based on Czech legislation.

In the Czech Anti-Money Laundering (AML) Act, the term “virtual asset” was established by the legislator. A virtual asset, as defined in the AML Act, is a unit stored or transmitted electronically capable of performing payment, exchange, or investment functions, except when it qualifies as a security, investment, or monetary instrument under the Payment System Act.

According to the AML Act, a virtual asset, in its broad sense, covers all types of crypto-assets described above, excluding tokens exhibiting characteristics of securities and qualifying as investment instruments under the Investment Company and Investment Funds Act.

According to the AML Act, a virtual asset, in its broad sense, covers all types of crypto-assets described above, excluding tokens exhibiting characteristics of securities and qualifying as investment instruments under the Investment Company and Investment Funds Act.

The Czech National Bank asserts that although Czech legislation does not recognise digital securities (except for dematerialized securities held in central or separate custody), foreign crypto-assets may be considered securities under foreign law. Similarly, Czech or foreign crypto assets may be regarded as derivatives under Czech and foreign law.

From the above, it follows that tokens acting as investments may fall under the definition of an investment instrument under the Investment Company and Investment Funds Act. For instance, a security token could be such an investment instrument. Therefore, anyone wishing to provide services related to security tokens can engage in such activities only based on a licence issued by the Czech National Bank and in line with the Investment Company and Investment Funds Act. A Czech VASP licence would be sufficient in all other cases. Further details about its capabilities are provided in our article “How we helped our client launch a cryptocurrency exchange in the Czech Republic?”

An exciting nuance

Due to the favourable climate in the cryptocurrency sphere in the Czech jurisdiction, individuals without a VASP licence in the Czech Republic are authorised to engage in the following activities:

- Simply accepting virtual assets as payment for goods or services;

- Managing a mining centre or mining pool;

- Issuing in-game currency (i.e., when a computer game operator issues in-game currency, but it is not considered a virtual asset).

Thus, despite the incompleteness of the legal regulation of the crypto sphere, we observe how European legislators are gradually taking steps to fill gaps in the legal status of crypto assets and related activities.

The Czech Republic is keeping pace with overall European trends and is systematically and flexibly introducing new norms to regulate the cryptocurrency industry, creating a favourable landscape for individuals wishing to engage in crypto activities within the Republic.

However, in Czech legislation, like in other jurisdictions, there are specific nuances, especially considering that the MiCA Regulation still needs to be in effect. In such intricacies, the company COREDO can assist you. Understanding the classification of crypto assets and their regulation is crucial for successful business operations in the Czech Republic and the European Union as a whole.

By Dmitry Vyalkov, LLM, lawyer at COREDO

————–

1 Please be advised that for the purposes of this article, the terms “crypto asset” and “token” are used synonymously.

2 Point 5 § 1 art. 3 of REGULATION (EU) 2023/1114 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 31 May 2023 on markets in crypto-assets, and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2019/1937 (hereinafter – “MiCA Regulation”). Date of access: 30.11.2023.

3 Directive on Markets in Financial Instruments repealing Directive 2004/39/EC and amending Directive 2011/61/EU and Directive 2002/92/EC (MiFID II). Date of access: 30.11.2023

4 Art. 11 of the MiCA Regulation

5 Points 8 and 9 § 4 of Zákon č. 253/2008 Sb. o některých opatřeních proti legalizaci výnosů z trestné činnosti a financování terorismu. Date of access: 30.11.2023

6 Zákon č. 240/2013 Sb. o investičních společnostech a investičních fondech (hereinafter “ZISIF”). Date of access: 30.11.2023