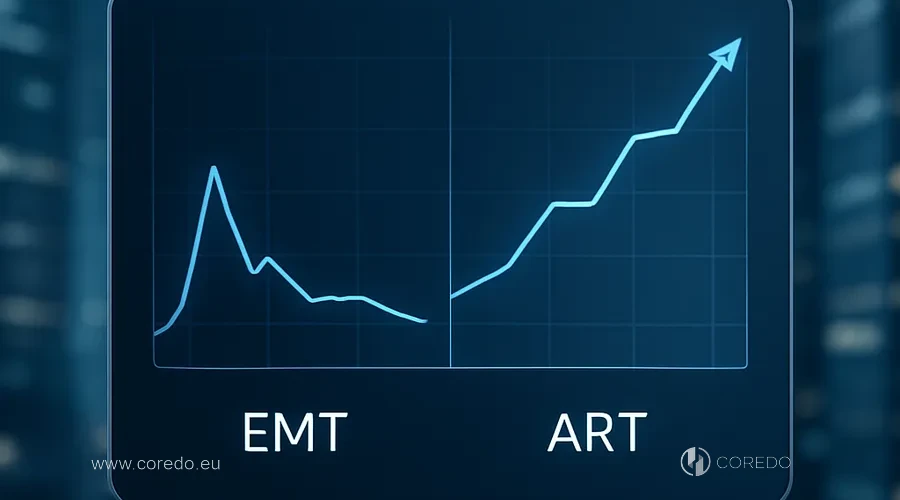

MiCA: EMT or ART for stablecoins

MiCA divides stablecoins into two basic classes:

- e‑money tokens (EMT): essentially tokenized electronic money, 1:1 pegged to a single fiat currency, most often the euro.

- asset‑referenced tokens (ART) – tokens pegged to a basket of currencies and/or other assets (for example, a multi-currency stablecoin or a token backed by a mix of fiat+bonds+gold).

- regulatory regime;

- reserve requirements;

- possibilities for use in payments;

- supervision (ordinary or “enhanced” for significant tokens).

When it makes more sense to use EMT

- the token is fully fiat‑backed (usually by the euro), without a multi-asset basket;

- the ability to position the product as a payment and settlement instrument rather than a speculative asset;

- strict requirements for the issuer: the status of an electronic money institution or a credit institution, full MiCA compliance and an e‑money regime.

For projects that target stablecoin use cases in payments, e‑commerce, B2B settlements and corporate treasuries, EMT most often becomes the default model.

When ART provides more flexibility

- issuing multi-currency tokens (for example, pegged to a basket of EUR+USD+CHF);

- including several types of assets in the reserve (cash, government securities, sometimes highly liquid commercial instruments);

- building more complex treasury and investment scenarios.

MiCA and algorithmic tokens: what’s prohibited

- a ban on algorithmic stablecoins in the EU in their familiar market form;

- the de facto exit from the European market of partially backed models where reserves do not cover 100% of liabilities;

- a tougher stance toward schemes where price stability is maintained only by an algorithm and market mechanisms, without transparent reserves.

- projects with algorithmic stablecoins either cease to be ‘stablecoins’ under MiCA, or take such a token outside the EU;

- exchanges and payment platforms will delist non-compliant tokens for European customers: otherwise they themselves risk being classified as CASPs;

- any model where the reserve is “something approximately liquid” without strict limits on quality and duration will not pass MiCA scrutiny.

Stablecoin reserves under MiCA: architecture and audit

- cash held in accounts with reputable banks;

- short-term government bonds (HQLA);

- strict limits on duration, concentration, and credit risk.

- obtain Licensing and regulatory supervision;

- withstand stress scenarios (withdrawal of 30–40% of assets over a short period);

- maintain acceptable project economics.

- legal structuring of the reserve through a separate SPV in the EU;

- segregation of reserves between bank accounts and an HQLA portfolio with strict limits;

- implementation of independent reserve audits with regular publication of reports for users and the regulator;

- documented stress-testing procedures and a liquidity plan in case of peak redemptions.

-

MiCA stablecoins with high-quality reserves will have a competitive advantage over ‘grey-zone’ tokens that European CASPs will sooner or later limit access to.

-

Large corporate users and financial institutions will look specifically at:

- the reserve structure,

- liquidity management procedures,

- independent audit.

Redemption rights under MiCA: holder rights and issuer economics

MiCA enshrines a key principle: a stablecoin holder has the right to redeem the token for fiat (or the underlying asset) at par, within a reasonable time frame and on clear terms.

- clear redemption procedures: who, where, in what format submits the request;

- predefined execution timeframes and fees;

- delineation of rights: retail users, professional participants, large corporate clients.

- programmable discounts on fees;

- priority access to liquidity and limits;

- integration of the stablecoin into DeFi infrastructure (there, yield is generated at the protocol level, not in the token itself, which is important for MiCA).

CASP, MiCA and passporting in the EU

Any issuer or platform working with stablecoins in Europe encounters the concept of crypto‑asset service providers (CASP).

- exchanges and brokers;

- custodians;

- payment and wallet providers;

- token issuance and placement platforms.

Key idea: by obtaining a CASP license in one EU jurisdiction, you gain passporting for services across the Union. This significantly increases the value of choosing the right country for registration and licensing.

- selecting an EU jurisdiction taking into account the required license (EMT/ART, CASP, e‑money, etc.), local regulator practice and the tax environment;

- designing a CASP compliance strategy in the EU: AML/KYC, the Travel Rule for cryptoassets, operational resilience, IT governance;

- support in preparing the white paper, internal policies, and contractual framework with users and partners.

AML/KYC and the Travel Rule: practical compliance

- The Travel Rule for crypto-assets, the obligation to transmit sender and recipient data for transfers, even when they occur in stablecoins;

- a harmonized AML approach at the EU level;

- increasing attention to cross-border stablecoin compliance.

- KYC/EDD processes for different types of clients (retail, corporate, financial institutions);

- transaction monitoring using risk scoring and scenario analysis;

- integration with sanctions and PEP-screening providers;

- AML policies that take into account not only EU requirements but also related regimes (for example, stablecoin regulation in Singapore or Hong Kong, if the project operates globally).

- MiCA and the European AML framework;

- the local regulator in Singapore;

- the forthcoming DAC8 requirements on the exchange of tax information for crypto-assets.

DAC8 and reporting on stablecoins

- the obligation to collect and transmit to tax authorities data on clients’ transactions;

- being brought within the scope of the automatic exchange of information (AEOI) for digital assets;

- the need to set up processes and IT‑infrastructure in advance, rather than ‘catching up’ with the regulator at the last moment.

- segmentation of clients based on their tax residency;

- the ability to generate reports in line with DAC8 standards;

- notifications and explanations for corporate clients so that their treasuries and chief financial officers understand how stablecoin operations will be reflected in reporting.

MiCA and liquidity management

- whether MiCA-compliant regulated stablecoins can be used for daily settlements with counterparties in the EU;

- how stablecoins affect liquidity management and treasury strategies;

- what to choose for international settlements: CBDC, stablecoins, or traditional bank payments.

- to develop a policy for using stablecoins in cross-border settlements with counterparties in Asia;

- to identify a pool of MiCA-compliant euro stablecoins with adequate reserves and compliance;

- to integrate these instruments into cash-management systems and counterparty risk limits.

- reduced cost and time of international payments;

- at the same time, MiCA compliance, the AML regime, and future DAC8 reporting.

MiCA and regulation in Singapore, Hong Kong, the UK and the US

- stablecoin regulation in Singapore – a balanced regime with an emphasis on payments and enterprise solutions;

- stablecoin regulation in Hong Kong and the emerging Hong Kong stablecoin licensing regime;

- the UK’s approach, where stablecoins fall within the perimeter of financial regulation but with its own specifics;

- the debate in the US around GENIUS Act stablecoins and competing bills.

- EMT/ART under MiCA – for access to the EU and eurozone markets;

- a license and architecture for Singapore: for Asian payments and corporate clients;

- possible integration with Hong Kong or UK regimes as a scaling option.

- reserves and transparency;

- consumer protection;

- systemic stablecoins and oversight by central authorities.

How we structure stablecoin projects at COREDO

-

Strategic session and model selection

- EMT or ART;

- payment, trading, or corporate-treasury focus;

- target jurisdictions: EU (specific countries), United Kingdom, Singapore, Dubai, etc.

-

Legal structuring and choice of jurisdiction

- registration of a legal entity in the EU, United Kingdom, Singapore, or another relevant jurisdiction;

- analysis of whether the issuer will combine roles: e-money, CASP, payment platform;

- preparation for licensing (financial licenses, crypto licenses, e-money).

-

Reserves and liquidity management

- reserve policy: composition, HQLA limits, allocation;

- daily, weekly, and stress liquidity management procedures;

- preparation for independent reserve audits and regular reporting.

-

MiCA compliance and governance

- development of a governance framework for the stablecoin issuer: governing bodies, controls, risk committees;

- preparation of the white paper in accordance with MiCA;

- implementation of operational and IT procedures for CASP.

-

AML/KYC and Travel Rule

- development of AML policies taking into account MiCA, the EU’s general AML directives, and the local law of the chosen jurisdiction;

- selection and integration of technological solutions for KYC, transaction monitoring, and the Travel Rule;

- training the client’s team and regular AML updates.

-

Tax and reporting architecture (including DAC8)

- analysis of tax implications in key jurisdictions;

- designing processes to meet DAC8 and AEOI requirements for crypto assets;

- integration with corporate accounting and treasury systems.

-

Scaling and cross-border strategy

- preparation for passporting CASP services across the EU;

- assessing expansion to Singapore, Hong Kong, Dubai, or the United Kingdom;

- adapting documentation and compliance to new regimes.

What an entrepreneur and a CFO should take into account

- Design the stablecoin from the start for MiCA, even if the initial launch focuses on another region. Reworking the architecture afterwards in Europe is costly.

- Treat reserves and MiCA compliance as part of the unit economics, not just a regulatory burden: access to European platforms and large corporate clients depends on it.

- Embed AML and DAC8 readiness from the outset: many business models collapse not because of the token idea, but because of inadequate compliance and reporting.

- See MiCA as an opportunity for differentiation: regulated stablecoins with transparent reserves and a clear legal framework will outperform “grey” alternatives, especially in the B2B and enterprise segments.