Nikita Veremeev

28.12.2025 | 6 min read

Updated: 28.12.2025

When an entrepreneur first turns to me with the question of opening a company abroad, I see in their eyes a mixture of ambition and uncertainty. Over nine years of working at COREDO I realized: the success of international registration depends not on luck, but on a deep understanding of local requirements, strategic planning and flawless execution at every stage.

Today I want to share what we have learned working with hundreds of clients from Europe, Asia and the CIS countries. This article is not just an overview of procedures. It is a practical guide based on COREDO’s real experience that will help you avoid common mistakes and build a reliable international structure.

International registration in 2026

The last two years have brought fundamental changes to the registration requirements for companies around the world. Whereas the process used to seem relatively standard, each jurisdiction has now tightened controls and implemented new technological solutions.

In the European Union, digital identification of founders and electronic signatures at all stages of registration have become mandatory. This sounds simple, but in practice it means you will not be able to rely on traditional paper documents. Our experience at COREDO has shown: clients who prepared digital versions of their documents in advance and completed video verification reduce registration times in the EU from 5–7 weeks to 1–2 weeks.

At the same time in Asia — in Singapore and Hong Kong — KYC procedures have been automated. A solution developed at COREDO for one of our fintech clients allowed integration of online verification through government platforms, which sped up company formation for foreign founders and significantly reduced legal risks.

But the main change is not technology. It’s the tightening of requirements for transparency and trustworthiness. Banks, regulators and government authorities now require full disclosure of information about beneficiaries, sources of funds and business reputation. And that’s correct. Because it protects both you and the financial system.

Choosing a jurisdiction: strategy

I often meet entrepreneurs who choose a country of registration based on a friend’s recommendation or the attractive website of the registration authority. This is a mistake that can cost months of time and tens of thousands of euros.

COREDO’s experience confirms: the right choice of jurisdiction is 60% of the success of the entire project.

In 2026 the most attractive jurisdictions for our clients remain Serbia, the UAE, Georgia, Uzbekistan and Cyprus. But each of them suits different scenarios.

UAE, if you’re looking for speed and tax incentives. Free Zones allow 100% foreign ownership, almost complete absence of corporate tax and registration within 3 days. However, documentation requirements here are the strictest in the region. The COREDO team has implemented projects where clients from Europe and Asia opened companies in Dubai, but only after thorough preparation of all documents on sources of funds and beneficiaries.

Georgia – if you want simplicity and transparency. A tax regime starting from 1% for small businesses, simplified reporting and fast online registration. There are no requirements for the tax residency of the owner here, which makes Georgia ideal for international entrepreneurs. The registration process takes literally a few days: you register on the State Registry website, undergo online identification and choose the business form.

Cyprus, if you are building a long-term European structure. Special tax regimes for holding structures, simple reporting in English and a high level of legal protection. Cyprus also offers residence through business investments – you can open a company, invest in the economy and obtain a residence permit.

Serbia: if you are looking for a balance between European regulation and accessibility for citizens from different countries. Serbia is more open to citizens from CIS countries than the Baltic states or Poland.

Documents for registration in 2026

When I talk to clients about the documents, I can see their faces fall. The list seems endless. But in fact there is a clear logic, and I will help you understand it.

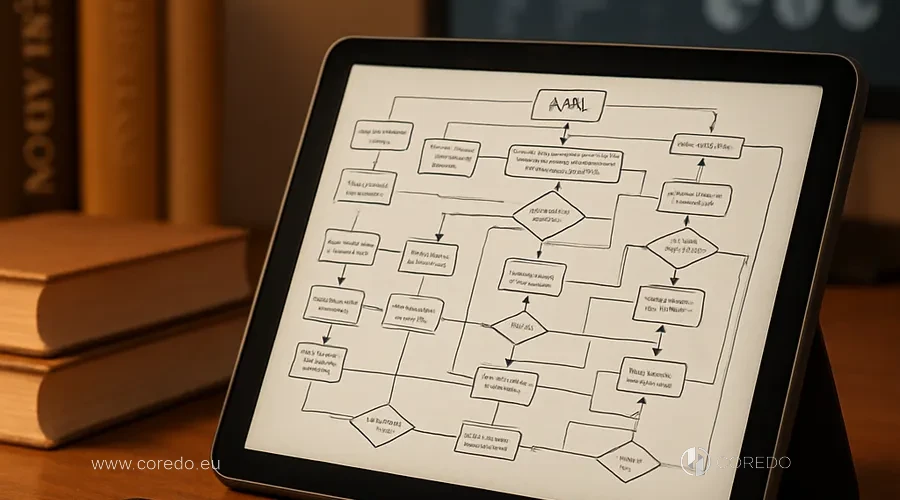

The standard package of documents for registering a company in the EU in 2026 includes:

- founding agreement and articles of association;

- proof of registered/legal address;

- digital identification of founders (video verification, eIDAS, BankID);

- KYC questionnaires and information about beneficiaries;

- proof of source of funds;

- electronic signatures.

Sounds standard? But this is where the real difficulties begin.

KYC questionnaires are not just a form. They are a document that determines whether a bank, regulator, and government authorities will approve you. I’ve seen clients lose months because they filled in one field of the KYC questionnaire incorrectly. For example, if you stated the source of funds as “investments” but did not provide supporting documents, the bank may request additional materials. And that causes a delay.

Proof of the source of funds — this is where the real work begins. Banks in 2026 require not just a list of documents. They demand the complete provenance of every euro or dollar you plan to use in the company.

- If your funds are salary, you need payslips for the last 12 months.

- If these are dividends from another company — you need extracts from the shareholders’ register and financial statements.

- If it’s an inheritance — you need court documents, the will, and bank statements.

- If it’s a prize or a gift: you need documentary proof with an explanation.

COREDO’s practice shows: clients who collect all documents on sources of funds in advance pass the bank review twice as fast as those who provide them on request.

Beneficiary information is another critical point. Regulators want to know not only who owns the company, but who actually makes the decisions. If you have hidden beneficiaries or a complex corporate structure, this may raise questions. The COREDO team has carried out projects where we helped clients transparently structure their business through SPV structures, which made it possible to optimize the tax burden and ensure full transparency of corporate governance.

Banking requirements 2026

Opening a company is only half the battle. The other half is opening a bank account.

And banks have become much stricter.

Banking requirements for new companies in the EU in 2026 include not only standard KYC documents. Banks now require:

- proof of business reputation;

- business plan;

- information about the corporate structure;

- source of funds;

- for high-risk businesses – full AML compliance and transparency of all transactions.

I remember a case when one of our clients, a successful entrepreneur from Asia, tried to open an account in a European bank without proper preparation. The bank requested documents about the source of his wealth. The client provided basic statements. The bank asked for more information. The client was shocked: “I’m a successful businessman! Why don’t they believe me?”

Because banks don’t trust anyone. It’s not personal. Their job is to protect the financial system from money laundering, terrorist financing and other crimes.

The solution we developed at COREDO for this client was simple: we collected a full package of documents confirming his business reputation, sources of income from his companies in Asia, tax returns for the last three years, and letters from his business partners. The bank approved the account in two weeks.

AML compliance: from theory to practice

Anti-Money Laundering (AML): this is not just a set of rules. It is a philosophy that should permeate your entire company.

In the EU, AML compliance requirements are strict and integrated into digital solutions. In Asia, requirements are strengthening and procedures are being automated. This means that you cannot simply “pass the check” once and forget about it. It is an ongoing process.

Our experience at COREDO shows: companies that implement AML compliance from the very beginning avoid problems with regulators and banks in the future.

What does this mean in practice?

Firstly, you must know your customers. It’s not just collecting documents. It’s understanding their business, sources of their income, their reputation. If a client operates in a high-risk sector (for example, in cryptocurrencies or precious metals), the requirements are even stricter.

Secondly, you must monitor transactions. If you see unusual activity, you must investigate it. If you see signs of money laundering, you must report it to the regulator.

Thirdly, you must train your team. Your employees should understand why AML compliance is important and how to comply with it.

The COREDO team developed for one of our fintech clients a complete AML compliance system that included automated customer screening, transaction monitoring in real time and regular team training. Result: the client obtained a financial institution license in the EU in 6 months, instead of the usual 12–18 months.

Company registration with foreign founders: requirements

If you are a foreigner registering a company in another country, you will face additional requirements.

Registering a company with foreign founders in Asia and Europe requires enhanced Due Diligence of the founders, verification of the source of funds and, often, obtaining a business visa for the founders.

What does this mean?

Due diligence of the founders is a check of your past. Regulators want to know: have you ever been convicted? Have you been involved in money laundering or financing terrorism? Have you been a director of a company that went bankrupt? All these questions will be checked.

Proof of source of funds are documents that show where your money came from. If you transfer €100,000 to a new company, the regulator will want to know where that money came from. This is not suspicion. It is a standard procedure.

Business visa — in some countries you may need a special visa to open a company. For example, in the UAE you can obtain a 5-year Green visa if you are an entrepreneur. In EU countries, a long-term category D visa is usually issued first, and upon arrival a residence permit is then granted.

COREDO’s experience confirms: foreign founders who prepare all documents in advance and undergo the necessary checks avoid delays and rejections.

Registration timelines: real figures

When a client asks: “How long will it take?” – I give an honest answer.

Registration timelines in the EU range from 1 to 5 weeks depending on the country. In Asia: from 2 to 6 weeks. But these figures are only for the registration itself.

If you add time for document preparation, due diligence checks, obtaining a bank account and implementing AML compliance, the real timeframe can be 2–4 months.

Our experience at COREDO shows: clients who start preparing documents 2–3 months before the planned registration go through the whole process smoothly. Those who wait until the last moment face delays and additional expenses.

Remote registration: pros and cons

One of the main trends of 2026 – the introduction of remote registration.

In the EU, remote registration has been implemented in many countries. In Asia it is being introduced gradually, depending on the jurisdiction.

This means that you can register a company without traveling to the country. You can undergo video verification, sign documents with an electronic signature, and receive the certificate of registration online.

But there are nuances. Not all countries allow fully remote registration. Some require personal presence at least at one stage. And even if the registration is entirely remote, opening a bank account may require a personal visit.

The solution developed by COREDO for one of our clients allowed him to register a company in Georgia completely online, and then open a bank account via a videoconference with the bank. The whole process took 3 weeks.

Tax planning from the very beginning

Choosing a jurisdiction is not just a matter of convenience. It’s a matter of taxes.

Different countries offer different tax regimes. The UAE offers an almost complete absence of taxes in Free Zones. Georgia offers a 1% tax for small businesses. Cyprus offers special regimes for holding structures.

But it’s important to understand here: tax optimization must be legal. You can’t just open a company in a low-tax country and hope you won’t be caught. Modern tax authorities exchange information through FATCA and other international agreements.

The COREDO team has implemented projects where we helped clients structure their businesses to minimize tax burden while remaining fully compliant with the law. This requires a deep understanding of the tax legislation of different countries and the ability to see the big picture.

After registration: what to do?

The company has been registered. The bank account has been opened. What now?

Now the most important thing begins: complying with all requirements and running the business in accordance with the law.

You need to register as a taxpayer. This imposes an obligation on you to keep financial records, which must be regularly submitted to the country’s tax authority.

The tax period and payment dates may vary between countries. For example, in the UAE the first financial year can be 6–18 months from the date of company registration, and subsequent years only 12 months. In Spain and Armenia the tax year coincides with the calendar year.

COREDO’s experience shows: companies that implement proper accounting and tax compliance processes from the very beginning avoid problems with regulators in the future.

Common mistakes when optimizing a website

Over nine years at COREDO I’ve seen many mistakes entrepreneurs make. Let me share the most common ones.

Mistake 1: Choosing a jurisdiction without a strategy. The client chooses a country because “they register quickly there” or “taxes are low there”, not taking into account their real needs. Result: the company is registered in the wrong place, and redoing this is expensive.

Mistake 2: Incomplete document preparation. The client provides a minimal set of documents, hoping it will be enough. The regulator requests additional materials. This leads to delays of months.

Mistake 3: Underestimating requirements for source-of-funds. The client thinks it’s enough to simply transfer money to the company’s account. The bank requests documents about the origin of the funds. The client cannot provide them. The account is blocked.

Mistake 4: Ignoring AML compliance. The client thinks that AML is only for large companies. The result: the regulator finds violations, fines the company, may